Currency Risk Management Platform

The Mechanic Trap

Too many finance leaders in SMEs find themselves stuck in a mechanic role. Every day, they patch, reconcile, rebuild: complex Excel models, endless budget revisions, board reporting, ad hoc analyses, accounting support... and still, they're expected to guide the company’s strategy.

But how can you steer if both hands are under the hood?

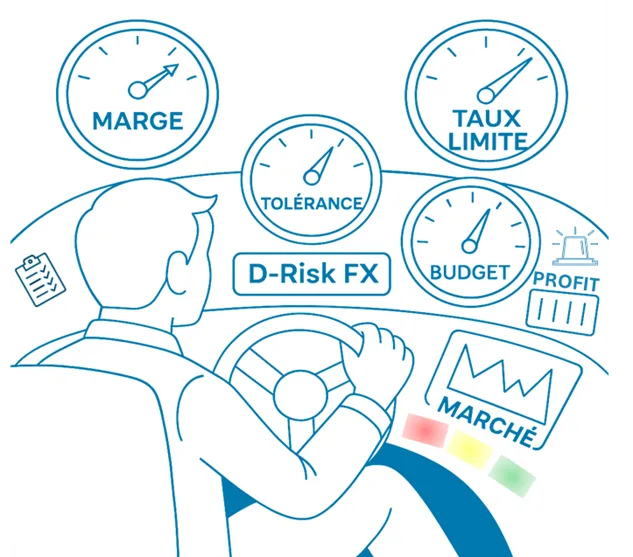

What companies need is not a mechanic, but a finance copilot — someone who knows what to do, when to do it, and how to keep the business on track. That’s where a a currency risk management platform like D-Risk FX comes in.

From Complexity to Clarity: A Strategy Powered by Data

Strategic finance starts with something too often overlooked: simplification.

Simplifying doesn’t mean cutting corners. It means allowing finance to refocus on what matters. With a currency risk management platform like D-Risk FX — especially in environments where currency management brings more confusion than clarity — this means:

-

A clear hedging strategy, aligned with your margin objectives and risk tolerance,

-

Automated analytics to see, understand, and adjust in real time,

-

Business intelligence accessible to all key stakeholders.

In just a few clicks, your company gains access to everything it needs — at the right time — to better protect its margins. D-Risk FX turns complex data into simple, proactive, and rigorous decisions.

Simplifying Access: The Foundation of Proactive Finance

As long as information remains scattered across spreadsheets, disconnected systems, and outdated tools, finance stays stuck in reactive mode. A currency risk management platform breaks down these barriers and centralizes key data:

-

A consolidated view of the gap between budget and actual exchange rates,

-

Real-time market data

-

A clear picture of exposures, hedges, and projected margins — by business line and by market,

-

Display of the limit rate at which your defined tolerance would be breached.

All key indicators are available at a glance: currencies used, market exposures, hedges in place, anticipated margins, and — crucially — the projected impact of volatility on your future profitability.

The D-Risk FX dashboard below illustrates this ability to centralize critical information and support confident decision-making.

Lightening the Load, Boosting the Impact

Time saved isn’t a luxury — it’s leverage.

With D-Risk FX, you gain in efficiency, structure, and above all, the ability to contribute meaningfully to the company’s strategy.

-

No more building manual models every month: simulations are built-in,

-

No more chasing numbers: they’re consolidated automatically,

-

No more navigating alone: the currency risk management platform provides a structured framework for decision-making and discussion — with your bank or your accountant.

Even the controller's role evolves: no longer just tracking, but helping to shape and steer strategy.

And the more international your operations become, the more valuable D-Risk FX becomes: complexity no longer slows you down — it informs and guides you.

This automation isn’t a black box. It’s a framework built for discipline. No speculation — just reliable data for secure, profitable management from day one.

From Copilot to Performance Leader

The real value of the finance role is revealed when your hedging strategy becomes a center of business intelligence.

With a currency risk management platform like D-Risk FX:

-

Strategy is built on your actual data — not assumptions,

-

Decisions are made at the right moment — in line with your risk tolerance,

-

Adjustments happen proactively — with full transparency,

-

Scenarios are simulated in advance — blind spots are flagged before they become emergencies.

You gain clear visibility across your entire FX exposure. And that visibility helps you make more aligned, more profitable, and more resilient decisions. The bigger your operations, the more value D-Risk FX creates.

Better decisions. Better control. Better performance.

A currency risk management platform: The Right Tool to Play the Right Role

In a world where currency volatility threatens SME margins, every decision matters.

A currency risk management platform gives CFOs, controllers, and VPs of Finance a central role again — that of strategic copilot. That role is built on three pillars:

-

A clear, tailored plan based on your actual data,

-

An executable strategy, supported by defined benchmarks and smart alerts,

-

A user-friendly platform that lets you protect margins, reduce costs, and activate real-time, customized business intelligence.

This isn’t magic. It’s control, discipline, and data-driven clarity — so you can decide with confidence. No more noise. No more improvisation. Just what your business needs to know, at the right time.

So the question isn’t “Can we simplify?”

The real question is: What would your impact look like if you were finally in the copilot’s seat?

And what if the copilot… was you — starting now?

You may also read:Protect Your Margins: Why Proactive Currency Risk Management Is Essential for SMEs , Latest Insights on Currency Risk.

For additional insights on currency risk management, visit: Bank of Canada – Currency Risk Management.