Currency Risk Management Policy

Economic Context and Currency Risk Management

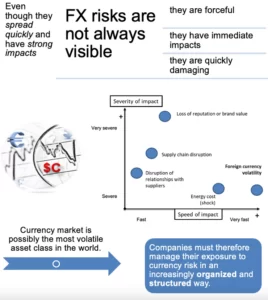

The dynamic forex market and global economic uncertainties demand heightened vigilance. Factors such as the end of President Biden’s term, central banks’ monetary policies addressing inflation, and geopolitical tensions surrounding the Ukraine war and the Middle East create unpredictable conditions for international trade. As a result, the forex market is now one of the most volatile asset classes globally.

The Velocity of Currency Risk

Currency risk is marked by rapid spread and severe impacts. These high-velocity risks require businesses to be especially cautious, as sudden and significant exchange rate fluctuations can have serious consequences. This makes currency risk management a critical need for businesses aiming to safeguard their operations.

The Importance of Structured Currency Risk Management

Structured and organized currency risk management is essential for companies to remain competitive. While the process may seem overwhelming, its benefits are clear. Mitigating risks stemming from exchange rate changes is achievable and vital, particularly during periods of heightened market volatility.

In fact, such volatility serves as a sharp reminder of the importance of preparation. Both small and large businesses are rethinking their hedging requirements, exploring innovative solutions to protect their margins and maintain competitiveness.

Innovative Hedging Solutions

Foreign investments and macroeconomic risks are prompting businesses to adopt cutting-edge hedging strategies. Pre-hedging preparation, such as identifying risks and defining policies, has become a cornerstone of successful currency risk management.

Instead of treating hedging instruments (like forward contracts or options) as the solution itself, companies now view these tools as outcomes of a well-defined risk management process. Integrating risk management within the operational cycle ensures a comprehensive approach to managing exposure.

Currency Risk Management in the Operational Cycle

Managing margins and cash flows at the risk entry point, and competitiveness and client relationships at the exit, emphasizes the central role of currency risk management in operational efficiency. Despite its invisibility in financial statements, the impact of currency risk is undeniable due to its unpredictability and rapid onset.

Large corporations often have dedicated teams for effective currency risk policies, but SMEs may lack such resources.

Outsourcing Currency Risk Management

Acknowledging time and resource constraints is the first step in developing a practical risk management strategy. This is why many SMEs choose to outsource the design and implementation of their currency risk management policies to specialists.

Companies increasingly adopt hedging portfolios reflecting their business activities, enabling them to manage exposure within acceptable parameters that align with their operational cycles.

Strategic Currency Risk Management

An organized approach to currency risk management ensures protection against unfavorable market movements while maintaining the flexibility needed for operational efficiency. This minimizes vulnerability to short-term trends and stabilizes the long-term financial impact of exchange rate fluctuations.

An effective policy embeds risk management within the operational cycle, securing a competitive edge by reducing revenue variability.

Preparation and Proactive Currency Risk Management

Preparation, not reaction, is the foundation of effective currency risk management. By understanding, measuring, and controlling exposure within the operational cycle, businesses can maximize the efficiency of hedging tools and achieve sustainable risk mitigation.

The ultimate goal is to answer: How much money will we have in our accounts over the next days, weeks, or months under the constraints of a highly volatile forex market?

Integrating Currency Risk Management Into Business Policy

Addressing this question through a robust currency risk management policy is key to determining appropriate coverage ratios and maturity structures. Collaborating with D-Risk FX enables SMEs to handle currency volatility while maintaining the agility needed to respond to evolving business dynamics.

This collaboration results in customized strategies to reduce exposure, protect operational profitability, and enhance financial stability.

Today’s SME managers are prepared for complex opportunities, and D-Risk FX empowers them to navigate currency risks with confidence and profitability.

Further Reading

For more insights on currency risk hedging, refer to this BDC article.

International Markets: A World of Opportunities

Expanding into international markets fosters growth but introduces risks for SMEs. Tracking the cascading effects of exchange rates on business performance can be particularly challenging.

D-Risk FX Budget & BI offers SMEs performance analyses, risk assessments, and scenario testing across markets, currencies, and business lines. This leads to tailored hedging strategies and real-time monitoring of anticipated performance.

Gain autonomy, automate processes, and approach foreign markets with a clear currency risk management strategy and robust tracking aligned with your business goals.