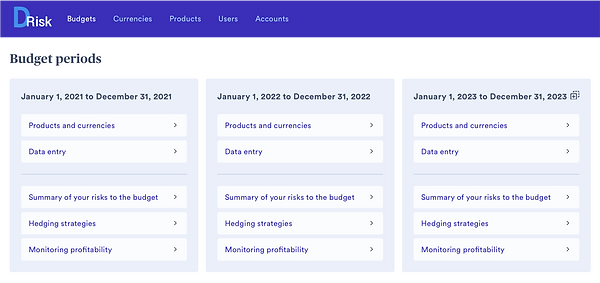

More than a multi-currency SaaS performance management platform, a budget planning tool designed for SMEs

D-Risk supports your budget process. Through its various sections, it allows you not only to establish your budget and coverage strategies, but also to monitor them and perform scenario analyses to evaluate the robustness of your business model.

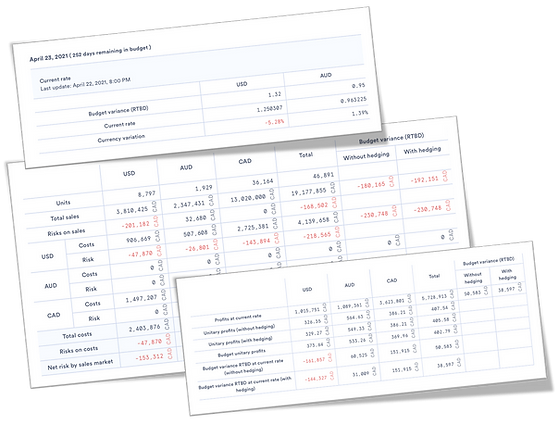

Summary of your risks to the budget section

Allows you to see an up-to-date multi-currency income statement, the allocation of your costs and your exposure to different currencies.

Measure the impact on the profitability of your business lines or your different export markets, based on your exchange rate scenarios,

Easily identify the risk/profitability profile of your products and markets.

Easily answer questions such as:

- Which market/product is most at risk?

- Do certain products compensate each other?

- Can you adjust your sales strategy to increase your profitability?

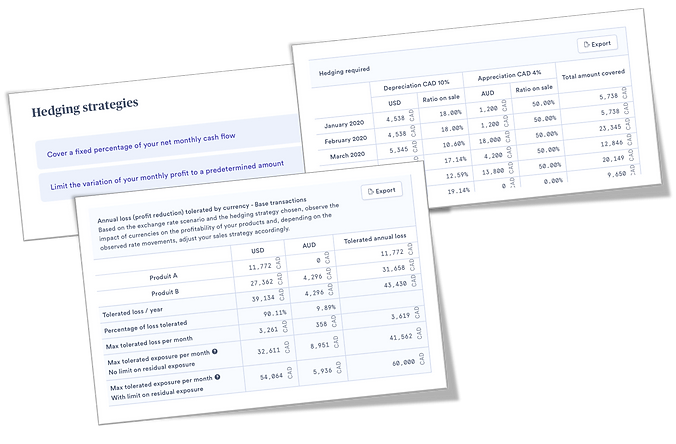

Hedging Strategy Section

Establish different hedging strategies:

- Depending on your risk tolerance

- With the operations to be carried out

- Your credit line needs

Validate the robustness of the strategy in the event of a scenario divergence

Easily answer questions such as:

- How many days of profit at risk does your strategy correspond to? Is that acceptable?

- How do my gross profit margins, price and exchange rates relate?

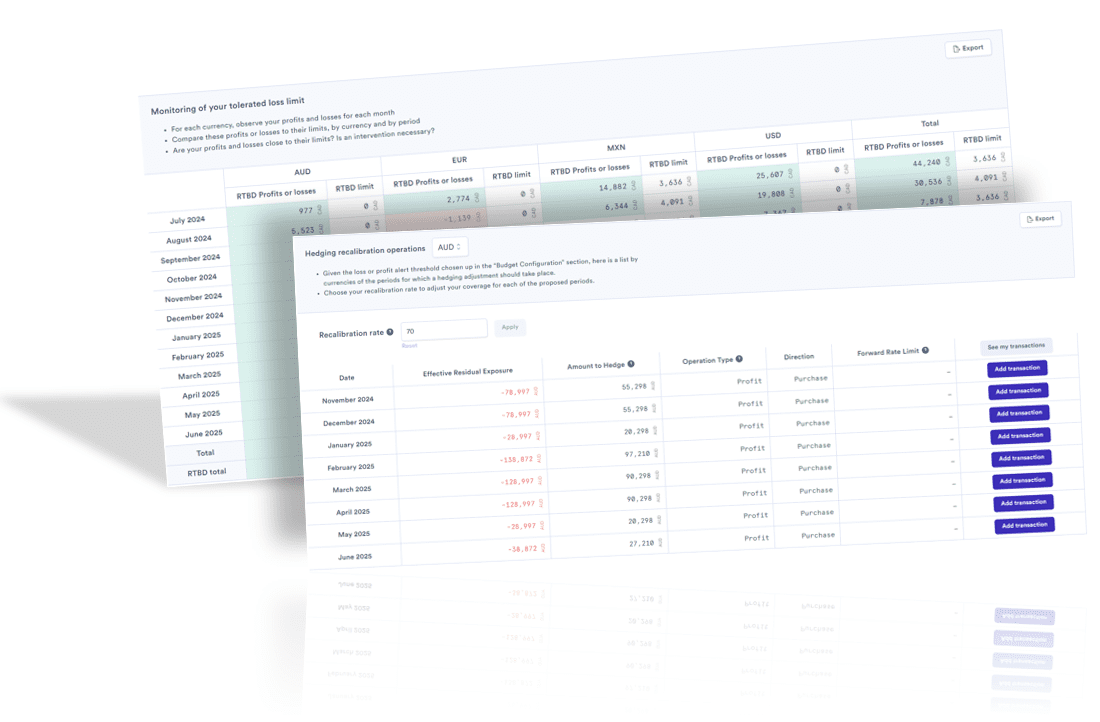

Profitability monitoring section

Once the strategies have been implemented, have a follow-up of your performance on a remain-to- be done basis, according to the daily rate.

See the differences in your budgets and profitability in real-time in your different export markets and according to your imports.

Determine your intervention thresholds to limit a loss or secure a gain.

Easily answer questions such as:

- Are you satisfied with the hedging strategy in place? Do your anticipated risks suit your tolerance by market and currency?

- Do you need to consider new measures to achieve the budgeted objectives?

- Do you need to consider new measures to enable the achievement of the budgeted objectives?