Impacts on currency risk management processes within corporate treasury

Digital disruption is affecting almost every industry and business operation. Most leaders anticipate how digital technology will change the way they operate in their organizations.

These technologies have a strong impact on corporate treasury processes. In addition, generation Z is becoming increasingly important within companies. This generation is technology-savvy; they are used to and like to interact with new technologies, and companies will have to get used to it.

Treasury functions are and will be changed by digital transformation. These new technologies are transforming the way we must approach treasury and, more specifically, the management of currency risks.

Currency risk management based on the Micro-services model

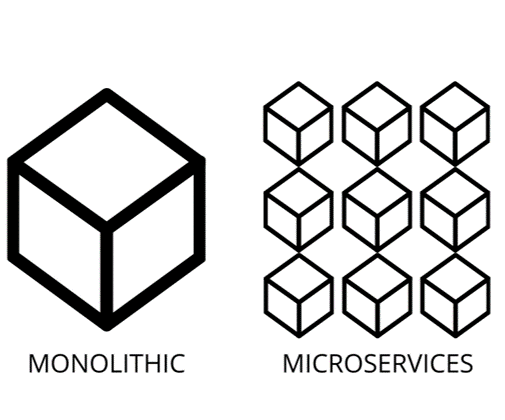

Monolithic technology architectures will be less and less present. They will be supplanted by a model based on microservices. Microservices are, by nature, modular and allow for independent functions, but are easily integrated with other microservices.

One of the great benefits of microservices is that new applications can be implemented with minimal to no disruption to the business. This allows for a more agile operation for SMEs of all sizes without requiring a large implementation or operating budget.

Add to these microservices for the treasury function the fact that virtual data centers (cloud) can securely manage heavy data loads in no time and at very low cost; the potential is confirmed and becomes a clear advantage.

Digital transformation facilitator

Reduced latency of cloud-based functions paves the way for simpler digital transformation for SME, an architecture model that is based on microservices is more agile and better meets the immediate business aspirations of enterprises. Their transformation is self-paced depending on the functions (microservices) they prioritize.

The digital transformation taking place today is enabling enterprise treasury to accelerate process automation and efficiency. More flexible and agile architectures should facilitate the digitization of the SME world. For the SME that trades internationally, foreign exchange risk management in the digital age is now possible.

A microservices-based model enables organizations to quickly deploy a solution, in a fraction of the time it used to take, to leverage their data to understand emerging trends in their operations and improve their decision-making processes.

D-Risk FX is part of this approach. This “plug & play” micro-service (software) models your budget and the currency risks you face to better reduce them according to your tolerance and profitability. With one click, you have an efficient currency risk management strategy and real-time performance indicators and dashboards to monitor your business lines in your different markets. No more large Excel worksheets.

______________________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SME performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.