Currency Hedging Strategy: Identifying Currency Risks

Currency Hedging Strategy: Understanding and Mitigating Currency Risks A currency hedging strategy helps companies mitigate the impact of exchange rate fluctuations on their financial stability. Businesses operating in multiple currencies are particularly susceptible to currency risks. For example, companies selling products in foreign markets and receiving payments in the local currency or purchasing goods in […]

Currency Hedging Strategy: Is a 70% Hedging Ratio Too High or Too Low?

Currency Hedging Strategy: Find the Right Hedging Ratio for Your Business The development of your currency hedging strategy begins with articulating your company’s attitude toward risk. Here are two critical questions to start your reflection: Currency Hedging Strategy: Risk Reduction Objective Is your goal always to reduce risk to zero? Or is it to maximize […]

Currency Risk Management Policy

Currency Risk Management Policy: Why It Should Be Part of Your Organization’s DNA Currency risk management is a cornerstone of international business success. With exchange rates fluctuating significantly, the importance of a robust policy cannot be overstated. Here’s how integrating it into your organization can protect your cash flows and enhance performance. Understanding Risk and […]

Currency Risk Management – A Strategic Approach to Protect and Optimize Cash Flows

What is Currency Risk Management? Currency risk management is the strategic process of protecting your business’s profitability and cash flows from the unpredictable impact of exchange rate fluctuations. In today’s volatile markets, managing currency risk is no longer optional; it’s essential for long-term growth and sustainability. Defining a Currency Risk Management Policy Running a business […]

Currency Risk Management – 5 Tips to Improve It

Currency Risk Management: Why It Matters More Than Ever Geopolitical events and currency movements are unpredictable, but your company’s currency exposure is within your control. If your business is exposed to currency risk, having a robust currency risk management strategy has never been more crucial. Global economies are still reeling from the effects of wars […]

Currency Risk Management: Managing Impact and Rapid Volatility

Currency Risk Management Policy Economic Context and Currency Risk Management The dynamic forex market and global economic uncertainties demand heightened vigilance. Factors such as the end of President Biden’s term, central banks’ monetary policies addressing inflation, and geopolitical tensions surrounding the Ukraine war and the Middle East create unpredictable conditions for international trade. As a […]

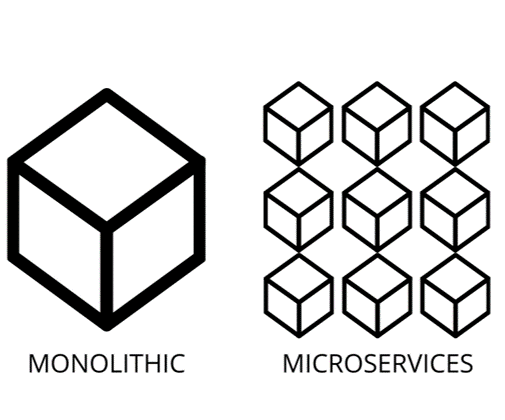

Digital Transformation, Currency Risk Management and SME

Treasury functions are and will be changed by digital transformation. These new technologies are transforming the way we need to think about treasury and, more specifically, currency risk management.

Currencies and inflation have kept the market on its guard

On inflation, central banks have been stating all along that inflation would fade out fast, and it seems they have been proven right. Inflation is generally slowing down.

COVID-19 Plan for recovery using your risk management policy as an anchor

This article follows the previous one which presented the macro-economic situation related to the COVID-19 pandemic.