Currency Hedging Strategy: Choosing the Right Hedging Ratio

Developing Your Currency Hedging Strategy: A Vital Step for Businesses In the previous article [1], we discussed the importance of clearly defining your approach to currency risk and using risk tolerance as a guide to determine the appropriate level of exposure for your business. The hedging ratio is the practical expression of this “level” of […]

Currency Hedging Strategy: Is a 70% Hedging Ratio Too High or Too Low?

Currency Hedging Strategy: Find the Right Hedging Ratio for Your Business The development of your currency hedging strategy begins with articulating your company’s attitude toward risk. Here are two critical questions to start your reflection: Currency Hedging Strategy: Risk Reduction Objective Is your goal always to reduce risk to zero? Or is it to maximize […]

Currency Hedging Strategy: Navigating Market Uncertainty

Currency Hedging Strategy A currency hedging strategy is a vital tool for businesses navigating the unpredictable world of foreign exchange markets. With regular currency fluctuations posing significant operational risks for exporters and importers, protecting your business from these challenges is crucial. A well-structured currency hedging strategy provides a roadmap to safeguard budgets, protect margins, and […]

Currency Risk Management Policy

Currency Risk Management Policy: Why It Should Be Part of Your Organization’s DNA Currency risk management is a cornerstone of international business success. With exchange rates fluctuating significantly, the importance of a robust policy cannot be overstated. Here’s how integrating it into your organization can protect your cash flows and enhance performance. Understanding Risk and […]

Currency Risk Management – A Strategic Approach to Protect and Optimize Cash Flows

What is Currency Risk Management? Currency risk management is the strategic process of protecting your business’s profitability and cash flows from the unpredictable impact of exchange rate fluctuations. In today’s volatile markets, managing currency risk is no longer optional; it’s essential for long-term growth and sustainability. Defining a Currency Risk Management Policy Running a business […]

Currency Risk Management – 5 Tips to Improve It

Currency Risk Management: Why It Matters More Than Ever Geopolitical events and currency movements are unpredictable, but your company’s currency exposure is within your control. If your business is exposed to currency risk, having a robust currency risk management strategy has never been more crucial. Global economies are still reeling from the effects of wars […]

Currency Risk Management: Managing Impact and Rapid Volatility

Currency Risk Management Policy Economic Context and Currency Risk Management The dynamic forex market and global economic uncertainties demand heightened vigilance. Factors such as the end of President Biden’s term, central banks’ monetary policies addressing inflation, and geopolitical tensions surrounding the Ukraine war and the Middle East create unpredictable conditions for international trade. As a […]

Is Your Currency Risk Management Strategy Sufficient in Times of Uncertainty?

Strengthen Your Currency Risk Management to Protect Against Market Volatility In today’s unpredictable economic and political landscape, it is essential for businesses to implement a robust currency risk management strategy. This not only helps in mitigating risks but also allows companies to regularly assess the effectiveness of their measures to safeguard profit margins. As such, […]

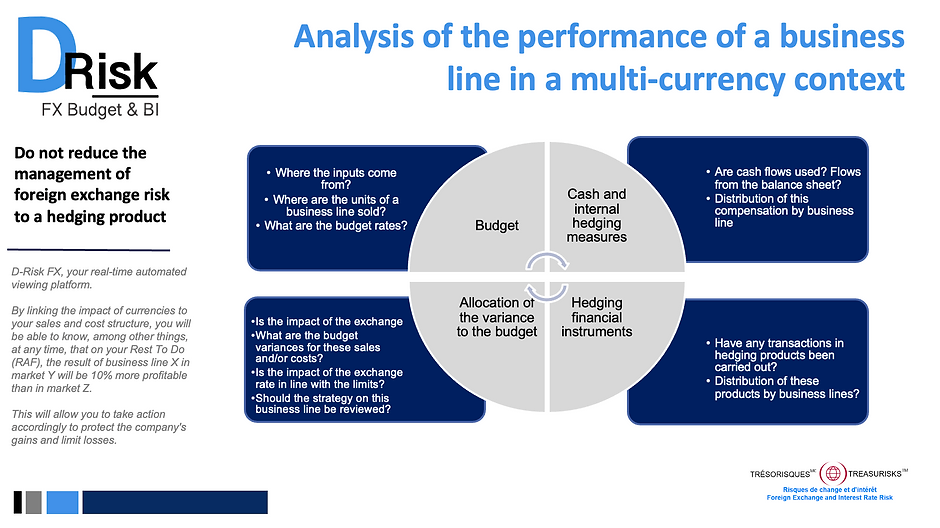

Analysis of the performance of a business line in a multi-currency context

Developing business abroad is a source of growth but involves risks for SMEs.