Foreign exchange risk management policy

Today’s SME manager is well equipped to respond to complex business opportunities, but many are still uncertain when it comes to navigating through exchange risk.

A constantly changing currency market and an uncertain global economic situation require extreme vigilance. Trump’s presidency, U.S. monetary policy, Brexit, protectionism and, even closer to us, the price of energy (petroleum) and raw material cover international trade with uncertainties. Currency market is becoming the most volatile class in the world.

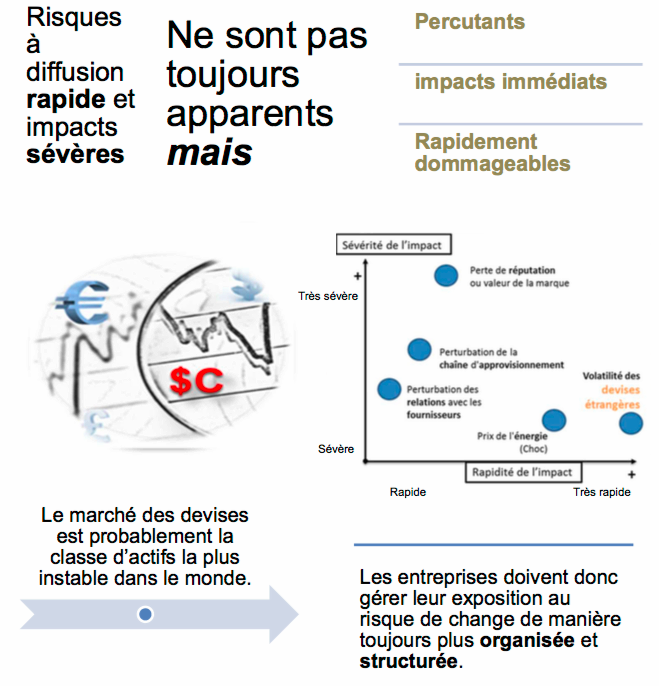

In addition, currency risk is one of those so-called rapid spread and severe impactrisks. Companies should be even more wary of these high velocity risks because they quickly hit the organization. Exchange risk management is a necessity because exchange rate movements, both in direction and amplitude, are sudden, unpredictable and can be very significant.

Companies must therefore manage their exposure to currency risk in an increasingly organized and structured way. It can be overwhelming for those unfamiliar with the processes, but, if managed properly, companies quickly reap the fruit of their efforts. Reducing the risks resulting from a change in the price of one currency against another is something that every business can and should do in order to stay competitive.

Nothing is more likely to stimulate the need to guard against currency risk than a period of marked market instability. Volatility is a vivid reminder of the importance of being prepared. Large and small companies are also starting to look at their hedging requirements from a new perspective.

Indeed, foreign investments and macroeconomic risks lead many companies to seek innovative hedging solutions in order to protect their margins and their competitive advantages. Work done upstream of the use of hedging products (futures contract, option, etc.) becomes the essential element of management.

The hedging product becomes the consequence of the management and not the management itself. The management of currency risk is repositioned at the heart of the operating cycle; where risk enters, is transformed and leaves the company. At the entry of risk, we manage a margin, a flow; at the exit, competitiveness, customer relationship.

The complexity of currency risk management cannot therefore be taken lightly. It is never explicit in the accounting statements; it can only be guessed! In addition, the speed at which its impact is felt, and its unpredictability adds to this complexity.

It is also noted that while large corporations have the funds to support a team dedicated to designing and implementing an effective currency risk management policy; this is rarely the case for SMEs.

Being realistic about your capacities (time and resources) is the first step in designing risk management, which is why SMEs often outsource the design and deployment of their exchange risk management policy to specialists.

Companies are increasingly interested in a hedging portfolio approach that reflects their business products. A company is thus better placed to manage its exposure within defined and acceptable parameters within its operating cycle.

This organized and structured way of managing exposure is designed to provide protection against unfavorable market movements while maintaining the flexibility required for optimal use of the business operating cycle.

Reduce vulnerability to short-term trends and smooth the impact of currency exchange over the long term.

An effective risk management policy is embedded within the operating cycle. It helps the company maintain its competitive advantage by minimizing the variability of its revenues.

Being prepared, and not reactive, in managing currency risks allows you to effectively support your international development.

Properly incorporating the answer to this question into a risk management policy is the basis for determining your coverage ratio and the maturity structure to use.

Your time and resources may be limited, but by working with Trésorisques, you can manage your exposure to currency market volatility while maintaining the flexibility to respond to changes and dynamics in your trading environment.

The result of this work is a tailor-made strategy allowing you to permanently reduce your exposure and thus protect the commercial profitability of your operations; therefore, improve your financial position.

Today’s SME manager is well equipped to respond to complicated business opportunities, the intervention of Trésorisques allows him to navigate the exchange on the basis of solid and profitable benchmarks.

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.