Market commentary – Q1 2023 – Currencies and inflation

Inflation, currencies and the banking system (SVB, CS) have kept the market on its guard. On inflation[1], central banks have been stating all along that inflation would fade out fast, and it seems they have been proven right. Inflation is generally slowing down. But, in some countries, like in the UK, inflation rates continue to hit incredibly highs level with March inflation still in the double digits.

The aggressive interest rates stance in the United States and the threat of « banking contagion» hit the stock markets. However, those fears were quickly diffused by central banks who stated clearly that banking systems remain robust. The US Federal Reserve continued fight against inflation still position the american currency as the safe haven currency although it has been a volatile 2023 for the US dollar against most currencies, including the Canadian dollar (CAD).

In the eurozone the single currency hit a high of 1.10 USD for 1 Euro and a low of 1,052 during the quarter. Trading just lower 1,10. Over the course of the first quarter, sterling has hit highs of 1.24 USD for 1 pound and a low of 1,18 while the Canadian dollar hit a high of 0,7525 USD (1,3275) for 1 CAD and a low of 0,7215 USD (1,3860).

The International Monetary Fund (IMF) forecast a recession in 2023 for the UK. It suggests an improved growth forecast for the US economy and the Euro zone. Canada, with an expected economic growth of 1.5%, should also avoid recession. Inflation, after climbing to 40-year highs in 2022 seemed like resorbing itself. However, one must remember that in an important economy like the UK, inflation rose to double digits in February, and the BoE’s raised interest rates to 4.25%.

UK

The CPI data decreased less than expected, to 10.1% in March from 10.4% in February. High inflation is still pressuring Bank of England (BoE) to raise interest rates. The markets are anticipating a 25-bps hike in May. Recent economic date suggest that the UK might avoid the recession predicted by the IMF. BoE is still expecting consumer price inflation to decline throughout 2023 to reach below 2% by the end of 2024. But things don’t always work as plan.

Euro zone

The European Central Bank (ECB) last raised its key interest rates by 50 basis points in March following a surprise increase in inflation in February. Then, readings in eurozone’s largest countries for March have shown a decline. Eurozone inflation fell from 8.5% to 6.9%. Germany, down from 8.7% to 7.4% and same direction for French, Italian and Spanish inflation. Will ECB reconsider its stance on interest rates given the more recent inflation numbers? For the time being the ECB has signalled more hawkish rate hikes ahead which could possibly keep the euro strong.

US

The US economy enjoy a stronger-than-expected jobs market among other positive signs. US core inflation has dropped from a peak of 6.6% at the beginning of last fall to 5.5% in February. The Fed raised its rate to 5%,

the second consecutive 25 basis point increase but it represents a slowdown in the rate of these increases. It could indicate a slowdown into the rising rates scheme.

On the political front, the person who will stand against Biden in 2024 is a significant unknown. The debt ceiling issue shall be back (June); this could affect the US dollar’s status as global reserve currency and weaken it. Despite the Fed raising interest rates to 5% in its last meeting, the USD weakened against the Euro and the Pound, and the Canadian dollar is Back toward it’s high of 0,75 USD. U.S. interest rates are likely to peak at 5.25 percent this year, before falling back to about 4 percent by 2025.

Canada

Canada’s inflation softened further and the anticipation for another rate hike from the US Federal Reserve is getting stronger. Recent data for Canada’s Consumer Price Index (CPI) showed that the Bank of Canada (BoC) should keep the interest rates stable at 4.5%. Canada’s inflation is steadily going lower. It shows that the actual restrictiveness in the BoC monetary policy is sufficient to limit inflationary pressure.

Central banks

Central banks[2] everywhere have aggressively raised interest rates, bringing it back to levels last seen before the global financial crisis. They want tight liquidity to reduce demand to force prices down and it looks like it’s going to work. Central banks do not want a situation where producers pass on costs and a wage-price spiral is started. They appear to be successful in many countries. Despite reversal in February in certain countries, most central banks still predict inflation ending 2023 lower than it is now.

it will be important to watch closely all coming Central bank meeting.

Currency exchange rate Predictions

At D-Risk FX We think that foreign exchange rates behave stochastically and as such, are unpredictable. For us, forecasts on FX rate are guesswork. No key financial decisions should be taken on their basis. A proactive risk management approach, as generated by D-Risk FX is way more appropriate for any business exposed to foreign exchange risk.

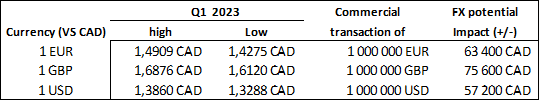

Nonetheless, in the table, using the high and low observed in Q1 2023 for different currencies, one can see how FX risk can be damageable to the profitability of a corporation. Please note that the discrepancy between the prediction of different financial institutions for currencies is often wider than these high and low. If you expect a net profit of 150 000 CAD on you Euro transaction, it’s more than 40 % of your net profit which is at risk[3]. Too much to let that to the unpredictable exchange rate prediction.

———

[1] See : Currency Risk: How To Take Volatility Into Account In Your Management?

[2] See: 5 Simple Ideas To Improve Your Foreign Exchange Risk Management

[3] See: What Is Meant by The Extent of The Risk?

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SME performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.