Currency Risk Management Policy: Why It Should Be Part of Your Organization’s DNA

Currency risk management is a cornerstone of international business success. With exchange rates fluctuating significantly, the importance of a robust policy cannot be overstated. Here’s how integrating it into your organization can protect your cash flows and enhance performance.

Understanding Risk and Currency Risk Management

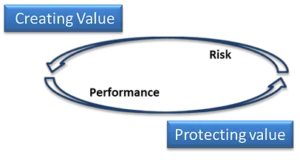

Risk represents the probability of events impacting business objectives positively or negatively. Some risks stem from internal factors like reputation or operations, while others, like currency volatility, are external. Currency risk management provides businesses with a structured approach to mitigate the financial impact of exchange rate fluctuations, ensuring stability and competitiveness.

What Is the Goal of a Currency Risk Management Policy?

It serves several purposes:

- Clarity in Responsibilities: Clearly defines roles and responsibilities in identifying and managing currency exposure.

- Consistent Practices: Ensures uniformity in risk management processes across the organization.

- Proactive Culture: Embeds currency risk management into daily operations, fostering awareness and best practices.

- Performance-Driven Approach: Aligns risk management with overall business objectives, turning risks into opportunities.

Why Implement a Currency Risk Management Policy?

Implementing a policy offers:

- Strategic Alignment: Aligns with business objectives to mitigate potential losses.

- Financial Stability: Protects cash flows and profit margins from currency fluctuations.

- Enhanced Bankability: Reassures banks and stakeholders of structured risk recognition and management.

- Operational Resilience: Identifies weaknesses in processes and supplier relationships, reducing vulnerabilities.

- Continuous Improvement: Acts as a feedback loop to refine strategies and drive growth.

When Does Currency Risk Management Become Essential?

Every business will eventually face market volatility. A currency risk policy ensures:

- Reduced collateral damage from currency fluctuations.

- Minimized costs of adverse effects.

- Enhanced data collection and analysis for informed decision-making.

With the right framework, organizations can turn potential threats into growth opportunities.

How Does Currency Risk Management Improve Competitiveness?

A company that manages its currency risks effectively gains a competitive edge by:

- Stabilizing pricing strategies.

- Protecting margins from volatile exchange rates.

- Building trust with international clients and partners.

Leadership’s commitment to integrating risk management into the company culture is critical for success.

Currency Risk Management as a Driver of Value Creation

Managing currency risk is not just about avoiding losses; it’s about unlocking sustainable growth. By implementing a structured currency risk management strategy, businesses can improve cash flow predictability, enhance financial health, and strengthen market positioning.

Why Your Business Needs a Currency Risk Management Policy

Exchange rate movements, often up to 20% annually, can erode profitability. A currency risk management policy mitigates these risks by stabilizing cash flows and reducing uncertainties tied to international markets. With tools like D-Risk FX, SMEs can streamline risk assessments, customize hedging strategies, and confidently navigate foreign markets.

Future-Proof Your Business

A well-implemented currency risk management policy transforms uncertainty into a competitive advantage. By integrating strategic tools and fostering a proactive approach, businesses can mitigate financial risks while enhancing operational efficiency. This approach not only safeguards profit margins but also supports innovation and agility in a constantly changing global market. Equip your organization to thrive by turning currency management into a pillar of your growth strategy.

International Markets: Unlocking Opportunities with D-Risk FX

International expansion offers immense growth opportunities but comes with currency risk challenges. Tracking the cascading effects of exchange rate movements on performance can be daunting for SMEs.

D-Risk FX simplifies currency risk management by offering scenario analyses segmented by market, currency, and business line. With a tailored hedging strategy and real-time monitoring, SMEs can confidently seize opportunities in global markets. Whether expanding into new markets or optimizing existing operations, a robust framework ensures your organization is ready to meet challenges and seize opportunities with confidence.

Automate your processes, gain autonomy, and unlock the potential of international markets with D-Risk FX.

For more insights on currency risk hedging, please refer to this BDC article.