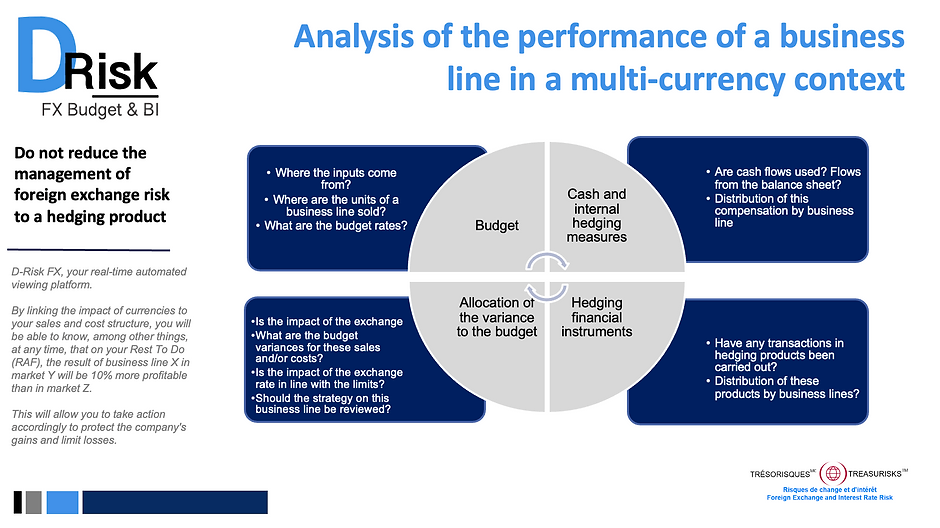

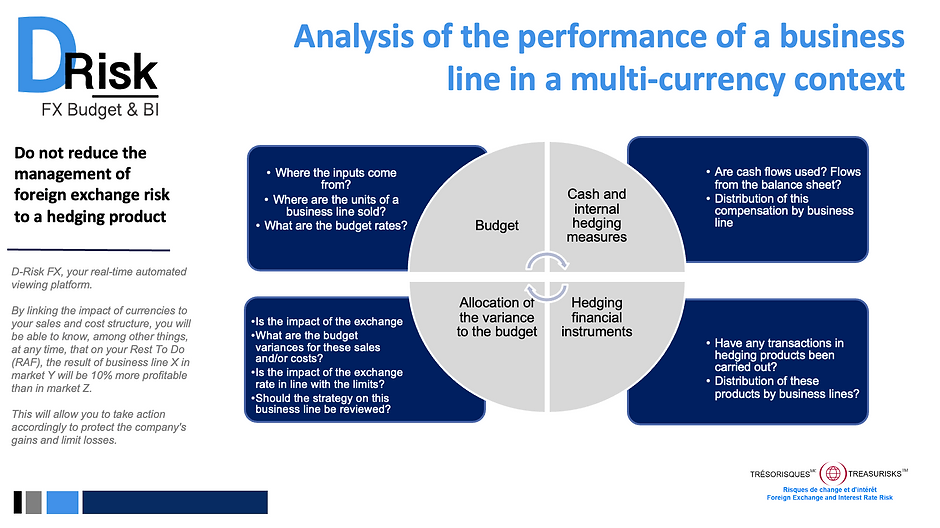

Analysis of the performance of a business line in a multi-currency context

Developing business abroad is a source of growth but involves risks for SMEs.

New markets, new currencies: a performance monitoring more complicated?

Expanding business abroad is a source of growth, but it also entails risks for SMEs.

Foreign exchange risk management: a lever to achieve your international goals?

Expanding business abroad is a source of growth, but it also entails risks for SMEs.

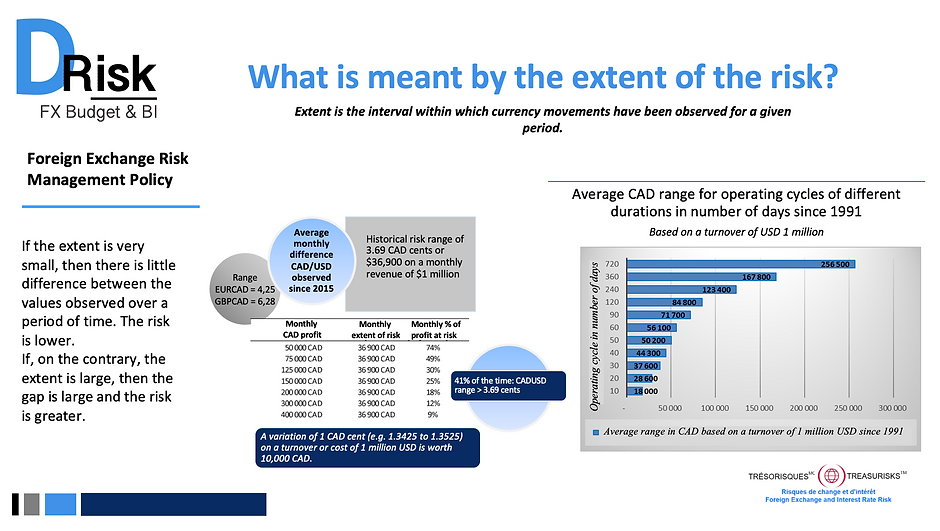

What is meant by the extent of the risk?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

Two markets, one measure? How to assess the hidden currency risk in the budget?

In a previous article, we discussed the use of volatility as a measure of uncertainty, the factors that influence it, and its impacts on SMEs.

Currency risk: How to take volatility into account in your management?

Volatility represents the change in the value of a currency and is of interest to us to the extent that it affects the company’s international operations.

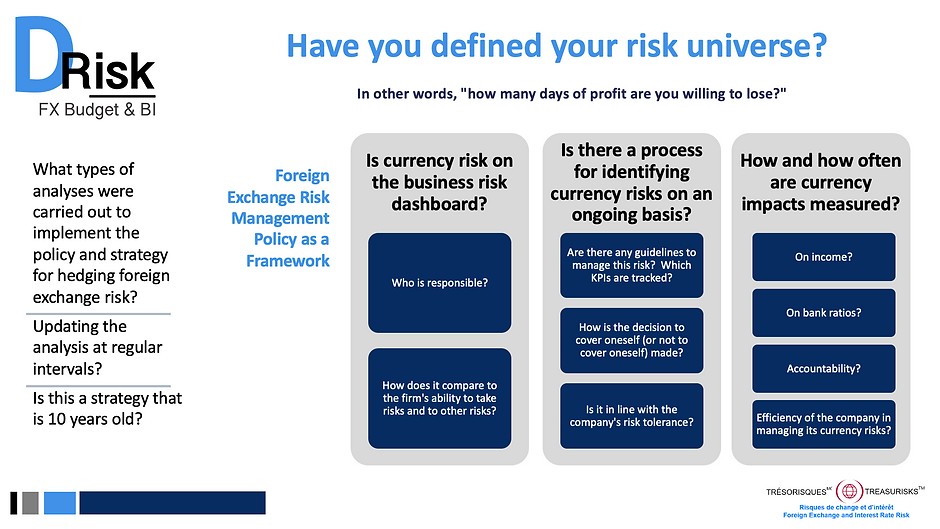

Have you defined your risk universe ?

Expanding business abroad is a source of growth, but it also entails risks for SMEs.

Resilience in times of crisis : Asking yourself the right questions

The Covid-19 pandemic and the accompanying sanitary measures have shaken our daily lives and the way we do business in an unprecedented way.

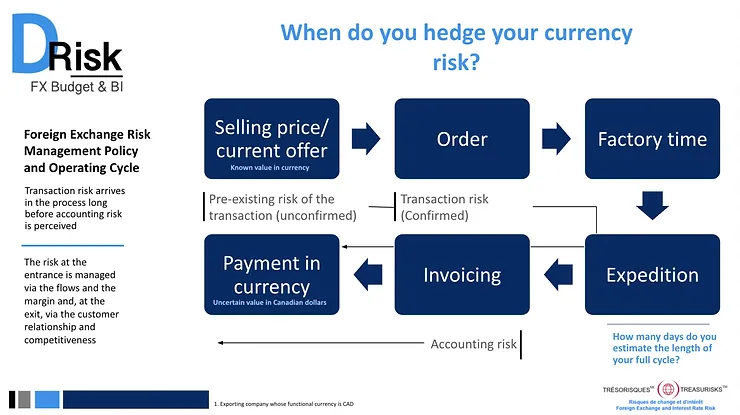

When do you hedge your currency risk?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.