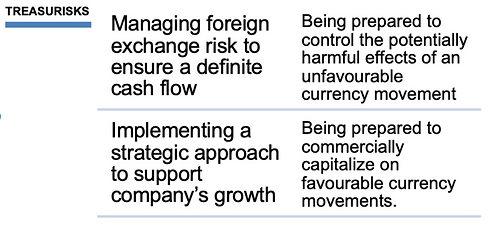

TREASURISKS provides the means to make decisions in a timely manner, on a factual and non-emotional basis in a rigorous framework.

Changes in the value of the Canadian dollar can significantly impact the profitability of a company and the valuation of its operations abroad (import and/or export).

The lack of an appropriate risk management policy aligned with the strategy of the company may leave the company exposed to negative outcomes. A rigorous framework becomes essential.

An effective policy will define a framework that supports the company’s strategy and facilitates the achievement of its objectives. From the start, it will identify key measures that will allow stakeholders to make an unbiased assessment about the policy.

With the policy, you can have a better understanding (identification, quantification and monitoring) of the impacts of the change in the value of the Canadian dollar on the various important financial variables like cash flows, asset values, Ebitda and debt clauses i.e. debt ratio, interest coverage, etc.

To design a risk management policy, it is essential to identify and monitor the variables specific to a company and the impact that the variations of the currency can have on them. This is how a policy can ensure that business objectives are not compromised by currency movements.

Because of the volatile nature of the foreign exchange market, it is important for companies to adopt a disciplined approach when managing foreign exchange risk. Prolonged periods of strong exchange rate movement occur regularly and contribute to significant variability in corporate cash flows, balance sheet items and profitability.

Since it is both impractical and impossible to reduce currency volatility, it is necessary to prioritize the risks and to implement a policy that aligns with the desired objectives,

the capacity and the risk tolerance of the company, while considering its budget constraint.

As the operating environment changes, the risk management policy must evolve to remain relevant to the specific needs of a company, because that is how it will help maximize owner / shareholder value. Knowing that, it becomes clear that this policy will be different for everyone, each company having its own version

The lack of a policy will leave a company unprepared to assume and deal with currency movements, which could lead to increased costs, reduced market share and lower profit margins.

The “one-size-fit-all” approach to foreign exchange risk management is problematic, or at the very least, not optimal. The foreign exchange risk management process must reflect the creating process of the company’s margin.

mplementing this process protects against adverse market movements while allowing optimal use of the business operating cycle in order to be ready to capitalize on favourable currency movements. Today’s SME manager must be well equipped to respond to challenging business opportunities. Treasurisks is there to provide support in order to navigate the complex universe of currency movements, based on solid and profitable benchmarks.

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.