Developing Your Currency Hedging Strategy: A Vital Step for Businesses

In the previous article [1], we discussed the importance of clearly defining your approach to currency risk and using risk tolerance as a guide to determine the appropriate level of exposure for your business. The hedging ratio is the practical expression of this “level” of exposure. Therefore, when developing a currency hedging strategy, it is crucial to carefully set the hedging ratio to better control margin variability.

Currency Hedging Strategy and Corporate Budgeting

Integrating a currency hedging strategy and risk management into the budgeting process is essential.

Let’s be clear: the goal is not to predict exchange rates but to anticipate your company’s performance. Currency risk is managed on a Remaining to be Done (RTD) basis; it can be analyzed using historical data but must be managed with a forward-looking approach.

Budget Rate

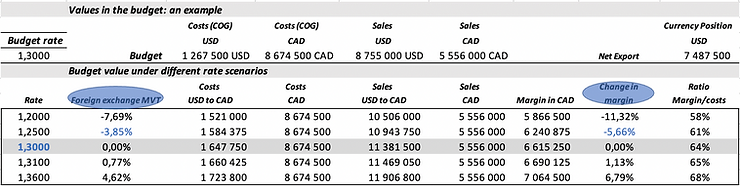

Currency risk management begins with a “budget rate [2]” set at the start of the budgeting process. This rate serves as a benchmark and defines the company’s risk profile. Based on this “budget rate,” anticipated revenues and expenses in foreign currencies are forecasted and integrated into the budget plan. These forecasts form the foundation for measuring the company’s exposure and calculating budgeted profit margins (targets).

Integrating currency risk management into the budgeting process is essential. As soon as budget preparation begins, the company must identify its currency position to understand its risk exposure.

Tolerable Variance, Threshold, and Budget Sensitivity

Next, determine the sensitivity of your budgeted margins to exchange rate fluctuations. How comfortable are you with the potential variations in your margins caused by exchange rate movements?

Based on your risk tolerance, estimate the unfavorable variance you are willing to accept around your budgeted margin. What are you prepared to lose in the event of adverse exchange rate movements to potentially benefit from favorable ones?

Determining the Threshold and Minimum Acceptable Margin

If you aim to eliminate variance, your currency hedging strategy must hedge your entire currency position at the budget rate—a costly and rarely optimal choice.

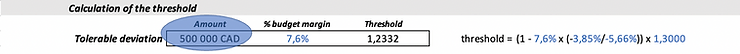

Using your acceptable budget variance and margin sensitivity, you can infer the exchange rate corresponding to your minimum acceptable margin (your exchange rate threshold). Any movement beyond this threshold would result in a loss greater than your acceptable risk.

For instance, if you assume an acceptable budget variance of CAD 500,000 (7.6% of your budgeted margin):

Without coverage, an adverse movement of 6.7 cents (1.3000 – 1.2332) reduces your expected budget margin by CAD 500,000.

Now that your threshold and minimum margin are known (6,615,250 – 500,000 = 6,115,250 CAD), let’s proceed by calculating our budget sensitivity indicator.

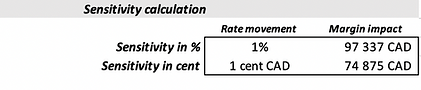

An appreciation of the CAD by 1% generates a budget variance of 97,337 CAD. Similarly, for a 1 cent CAD movement, the variance will amount to 74,875 CAD (6,690,125 – 6,615,250 = 74,875).

From the budgeting process, the company knows its threshold, sensitivity, and target margin, allowing it to effectively address the following three possible scenarios:

- Any forward exchange rate above its budget rate will secure a favorable variance to the budget.

- Any forward exchange rate above its threshold will limit the margin reduction within the tolerable variance.

- Any forward exchange rate below its threshold will create an unfavorable budget variance greater than the tolerable variance.

The Role of the Hedging Ratio

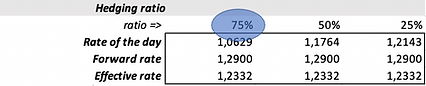

The hedging ratio’s role is to delay the threshold of CAD 1.2332 per USD by reducing the sensitivity of your budgeted margins to exchange rate fluctuations.

The thinner the margins, the longer the business cycle, and the more volatile the budgeted currencies, the higher the hedging ratio should be.

Using a forward contract, a company can determine today the rate at which it will transact a portion of its USD position later in the year. Consequently, part of its sales will be conducted at the forward rate and the remainder at the prevailing spot rate. The effective rate must be simulated and compared to the threshold to determine the comfort zone and associated ratio.

Choosing the Hedging Ratio

In our example, if the company secures a forward rate of 1.29 for a given month on 75% of its USD position [3], the spot rate for that month could drop as low as 1.0629 [4] before the acceptable variance is exceeded—a movement of nearly 24 Canadian cents or 18% compared to the budget rate.

For a 25% hedging ratio, the spot rate would need to be 1.2143—slightly over 8.5 cents or 7%.

A 75% hedging ratio, as part of your currency hedging strategy, may seem excessive for the initial budget months. While an 18% short-term movement is possible, its likelihood is low. However, this ratio might be appropriate for a company with low risk tolerance, thin margins, a particularly long business cycle, and highly volatile currencies.

D-Risk FX: Your Partner in Currency Hedging Strategy

D-Risk FX simplifies developing your currency hedging strategy and risk management approach by treating it as a core part of your budgeting process, making real-time tracking simple and accessible.

By favoring forward-looking analyses over mere “reporting,” D-Risk FX enhances profitability and manages currency risk effectively.

By linking budget margins to exchange rates from the start, D-Risk FX empowers you to act to protect your company’s gains and minimize losses, ensuring you achieve your objectives.

The Global Market: A World of Opportunities

Expanding internationally brings growth opportunities but also risks, particularly for SMEs. Exchange rate fluctuations can significantly impact success or failure in international markets.

With D-Risk FX Budget & BI, monitor each market’s performance in real-time while considering your hedging strategies.

Tackle these markets with the confidence of a clear currency risk management strategy and tracking tools aligned with your ambitions.

For more details, refer to the articles: Currency Hedging Strategy: Identifying Currency Risks and What is currency hedging | BDC.ca

Sources:

[1] See: Currency Hedging Strategy: Is a 70% Hedging Ratio Too High or Too Low?

[2] Generally, a rate between the spot and the one-year forward rate.

[3] (75% x USD Position) / USD Sales = Equivalent hedging ratio on sales (64.14%).

[4] (1.29 x 75%) + (1.0629 x 25%) = 1.2332.