Running a company is no small task. Identify potential customers and win them over; finance and develop the company; in short, manage an operating cycle efficiently, from beginning to end. It is frustrating to think that the company’s profitability can be eroded by currency’s volatility, especially because currency risk is manageable.

The political and economic climate in which we find ourselves is more uncertain than ever and is bringing currency movements to the fore. One need only look at the disparities between the banks’ forecasts for the next 12 months to be convinced that no one really knows what will happen in the short term.

In fact, it’s fair to say that markets are currently driven more by political events than economic data. However, despite these uncertainties, too many companies consider their currency risk at the end of the process rather than at the beginning. The management strategy must be clear as soon as a sale (a purchase) abroad is considered.

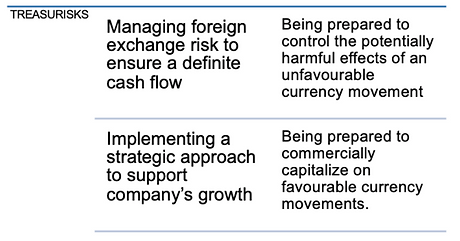

Managing currency risk is not a way to improve the financial flow of the company but to preserve it in order to support its growth. Hedge funds are playing with speculation; not commercial company. In this sense, Treasurisks advocates an approach that aims to endow the company with a defined cash flow.

To do this, we frame the currency risk within a tailor-made management policy. This policy helps ensure that the company has the funds to meet its obligations and, of course, to support its growth over time, regardless of currency movements.

Too many companies assimilate currency risk management only with hedging instruments (option, forward contract, etc.), while the use of these instruments is only the consequence of a risk management process and not management itself.

Locking in a future exchange rate by using a forward contract, for example, directly affects the price of the product sold and its profitability. Using these instruments should be considered as a tactical approach within the company’s pricing process. It is therefore important to frame this use within a tailor-made policy because the nature of the company’s operating cycle determines the sensitivity of its profitability to currency fluctuations.

Solutions to currency risks are not found in the currency market, but primarily in the detailed analysis of what makes your company unique: its operations. The currency market is the same for everyone, but your operating cycle is unique. Most of the time, people focus on rates, but they are the same for everyone … Instead we should think in terms of profit margin or rather, on how this margin is built within the company’s operating cycle.

The “one-size-fits-all” approach to currency risk management is problematic or, at the very least, not optimal. It is only based on this in-depth knowledge of the operation that we can provide guidance on currency risk management in companies.

Currency risk management process is established against the specific context of a company so that decisions reflect the process of creating its margin. The specific context of the company must be related to the context of the markets, but ultimately the company’s margin is the overriding decision-making factor.

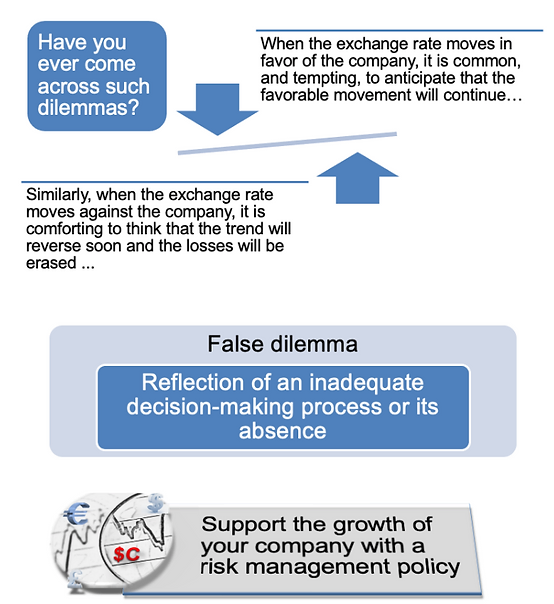

In fact, when the exchange rate moves in favor of the company, it is common, and tempting, to anticipate that the favorable movement will continue. Similarly, when the exchange rate moves against the business, it is comforting to think that the trend will reverse soon and that the losses will be erased. Such a dilemma reflects poor decision-making, or the lack thereof.

Being prepared for currency volatility instead of reacting to it means implementing a policy to manage your exposure in an organized and structured way.The policy provides protection against adverse market movements while maintaining the flexibility required for optimal use of the company’s operating cycle.

In order to reduce vulnerability to short-term trends and smooth out the impact of currency risk over the long term, hedging products must be used in a process closely linked to the company’s operating cycle; this link will allow them to reach their full potential and that is what a risk management policy must generate.

Today’s SME manager must be well equipped to respond to challenging business opportunities. Treasurisks is there to provide support in order to navigate the complex universe of currency movements, based on solid and profitable benchmarks.

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.