In the previous article [1], we discussed the importance of clearly defining our attitude to foreign exchange risk and using tolerance as a guide to an adequate “degree” of exposure for your business. The hedging ratio is the practical expression of the “degree” of exposure. It is therefore important to properly configure its use to better control the variability of its margins.

Currency risk and budget within your company

From the outset, let’s face it, it’s not about forecasting exchange rates but about anticipating the performance of your business. The risk is managed on a Rest-to-Do (RAF) basis; it can be analyzed with past data, but it is managed in the future.

Budget rate

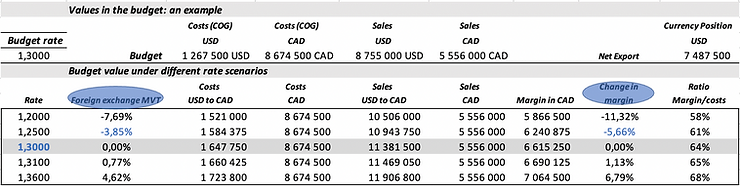

Currency risk management starts with a “budget” exchange rate; it is set at the beginning of the budget process. This rate becomes a reference indicator; it marks the risk of the company. Based on this “budget” rate [2], the expenses and foreign exchange income for future activities are estimated. These forecasts shall be included in the budget plan. They are the basis for measuring the company’s exposure and calculating margins to the budget (targets).

It is essential to link foreign exchange risk management to the budget process. As soon as the preparation of the budget begins, you must give yourself the means to know your risk by establishing your currency position.

Tolerable deviation, threshold, and budget sensitivity.

Next, determine how sensitive your budgeted margins are to changes in exchange rates. Are you comfortable with changes in your margins induced by the movement of exchange rates?

Then, based on your risk tolerance, estimate the unfavourable spread you are willing to accept around your budgeted margin. What are you willing to lose in the event of an adverse rate movement to be able to improve your margins during a favourable movement of exchange rates?

If you do not want a gap, you will have to cover your entire currency position at the budget rate; an expensive and rarely optimal choice.

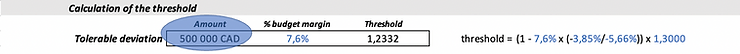

Depending on the deviation from the acceptable budget and the sensitivity of your margins, it becomes possible to infer the exchange rate corresponding to your tolerable minimum margin (your threshold exchange rate). Any move beyond the threshold rate would cause you to lose more than you are willing to risk. By hypothesis, we assume a deviation from the acceptable budget of 500,000 CAD or 7.6% of your margin to the budget.

Without hedging, an adverse move of 6.7 cents (1.3000 – 1.2332) decreases your expected margin to the budget by 500,000.

Now that your threshold and minimum margin are known (6,615,250 – 500,000 = 6,115,250 CAD), let’s continue by calculating our budget sensitivity indicator.

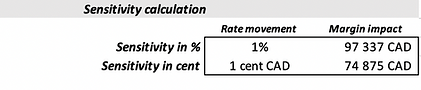

A CAD appreciation of 1% generates a gap in the company’s budget of CAD 97,337, or, for 1% CAD, the difference will be CAD 74 875 CAD (6 690 125 – 6 615 250 = 74 875).

From the budget process, the company knows its threshold, sensitivity and target margin and can therefore adequately cope with the following three possible scenarios:

(1) Any forward exchange rate above its budget rate will enable it to secure a favourable deviation from the budget;

(2) any forward exchange rate above its threshold will allow it to limit its margin reduction within its tolerable spread;

(3) any forward exchange rate below its threshold will set an adverse budget spread greater than its tolerable deviation.

Role of the hedging ratio.

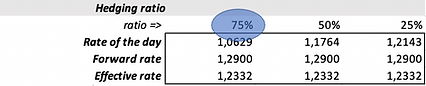

The role of the hedging ratio is to delay reaching the threshold of CAD 1.2332 per US dollar (USD) by reducing the sensitivity of your budgeted margins to changes in the exchange rate.

The smaller the margins, the longer the operating cycle and the more volatile the currencies on the budget, the higher the ratio should be.

Using a futures contract, the company now determines the rate at which it will trade later in the year on part of its USD currency position. Therefore, part of its sales will be made at the forward rate and the other at the rate prevailing on the day the company receives the proceeds of its sale. It is this effective rate that we must simulate and compare to our threshold to determine our comfort zone and the ratio associated with it.

Choice of hedging ratio.

If the company has a forward rate of 1.29 for a given month on 75% of its position in USD currency [3], the current rate for that month can therefore be as low as 1.0629 [4] before its tolerable spread is exceeded.

A movement of almost 24 Canadian cents or 18% compared to its budget rate.

For a ratio of 25%, this rate of the day should be 1.2143 or just over 8.5 Canadian cents or 7%.

In our example, a ratio of 75%, at least for the first few months of the budget, seems exaggerated. A move of 18% in the short term is still possible, but its probability of occurrence is low. Nevertheless, it could be appropriate for a company with low-risk tolerance and margins with a particularly long operating cycle using particularly volatile currencies.

When a company is said to be over or undercover, reference must be made to the distance between the required daily rate (1.0629) and the budget rate (1.30) for the effective rate to become equal to its threshold (1.2332 = effective rate) to be reached.

There is no mathematical rule as to the ideal distance; there is only the one you are comfortable with. Being “under hedged” entails costs through overuse of financial products and restricts your credit facilities while being “undercover” leads to risk-taking that is not aligned with the needs of your business.

D-Risk FX facilitates the development of your foreign exchange risk management strategy by treating it as part of your budget process and makes its monitoring simple and accessible in real-time.

Forward-looking analysis rather than “reporting” should be favoured to improve the company’s profitability and manage currency risk. The risk can be analyzed with past data, but it is contained in the future based on the company’s Rest to Do.

By linking, the establishment of your budget, and the realization of your margins to the exchange rate, D-Risk FX allows you to take action to protect the company’s gains and limit the losses to achieve your objectives.

[1] See Is a coverage ratio of 70% too much or insufficient?

[2] See Build your tool to compare the performance of different markets during budget planning. Generally, a rate between the spot and the forward rate is 1 year.

[3] (75% x USD currency position) / USD sales = Equivalent hedging ratio on sales (64.14%)

[4] (1,29 x 75%) + (1,0629 x 25%) = 1,2332

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI offers SME performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.