The Covid-19 pandemic and the accompanying sanitary measures have shaken our daily lives and the way we do business in an unprecedented way.

This difficult situation presents us with three options:

1) do nothing and let things go,

2) react as problems arise, or

3) take a moment to ask yourself the right questions, implement or improve your risk management and seize opportunities.

When it comes to currency risk, the option of doing nothing can be very dangerous and put the sustainability of the business at risk. The option of being in reaction mode can be costly and non-optimal because decisions will be based on emotion and not analyzed in a context of integrated risk management and long-term strategy of the company.

The third option allows you to take a step back and assess the risks and potential opportunities that emerge in any crisis and is a strategy that brings value to the company.

For example, the exercise could lead to the possibility of acquiring or investing in companies that they do not have your balance sheet strength or rather present an opportunity to diversify your product offering, reach new markets, integrate vertically, enter a new sector. Or, the exercise could lead to getting out of an unprofitable line, and thus get rid of a lame duck.

These strategic questions must be accompanied by a review of risk management policies and in particular that of currency risk management. Risks, both at the level of supply chains and those arising from macroeconomic phenomena such as sovereign debt, trade tensions, and inflation will become increasingly important. Their impacts are rarely isolated or short-lived.

These risks have a direct and instantaneous effect on the frequency and magnitude of currency fluctuation.

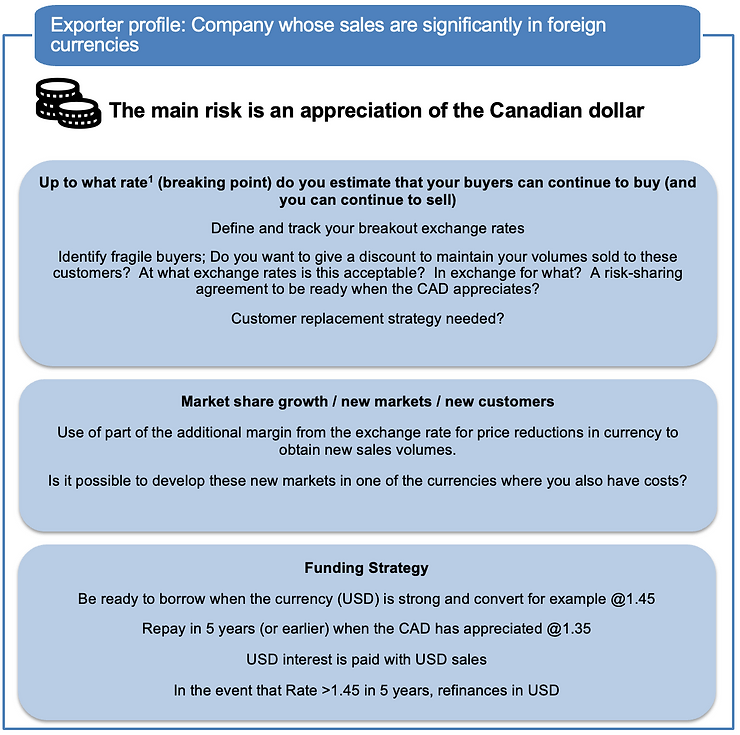

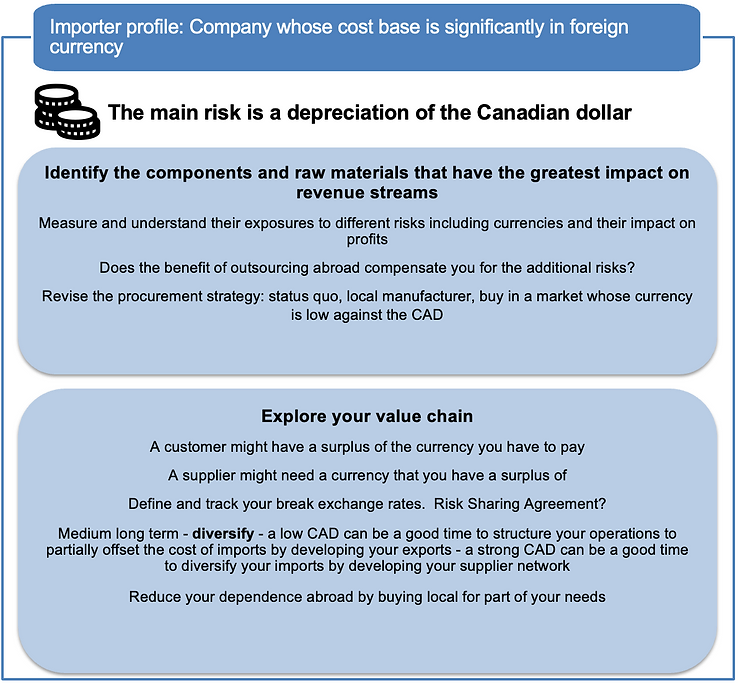

Currency risk will materialize differently depending on your operating structure. Here is an overview of questions and specific strategies based on your operational profile (exporter or importer) that can allow you to improve your foreign exchange risk management policy and thus make your business model more resilient.

1 Breaking exchange rate: rate at which your large customers will have difficulty paying you and similarly between you and your foreign suppliers.

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.