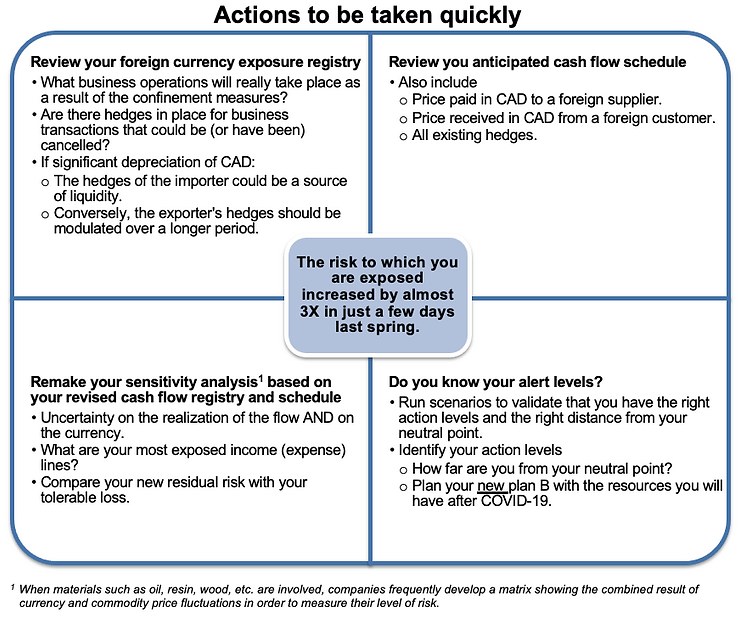

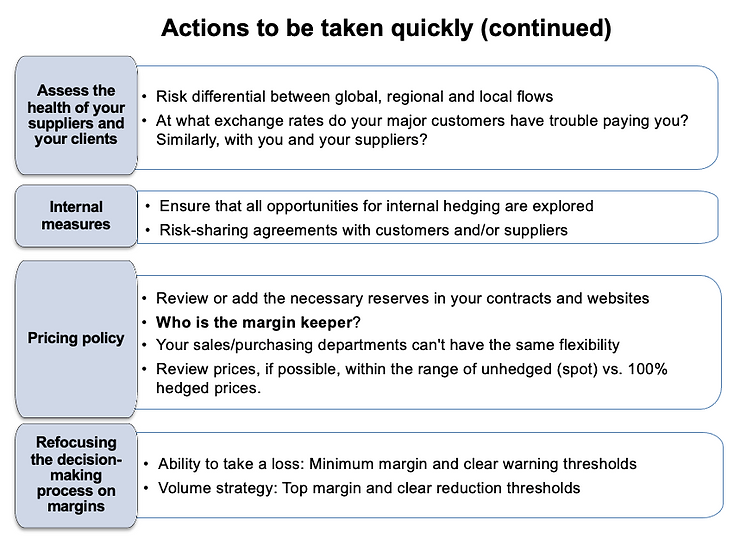

Actions to be taken

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery, we can anticipate that trading ranges, as reflected by the extent of risk, will be higher than their historical averages.

This article follows the publication Coronavirus and currency risk. What to do? It presents you with measures to better control your profitability in a volatile exchange rate context.

These measures reduce the vulnerability of your business model to short-term exchange rate trends and, in the long term, smooth their impacts. However, the flexibility of your operations is maintained in order to commercially capitalize on favourable currency movements.

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.