Two markets, one measure? How to assess the hidden currency risk in the budget?

In a previous article, we discussed the use of volatility as a measure of uncertainty, the factors that influence it, and its impacts on SMEs.

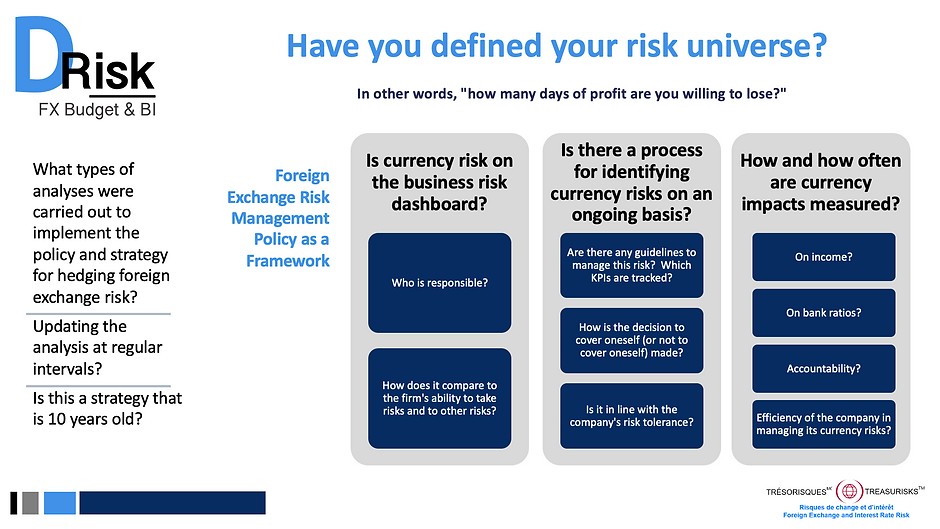

Have you defined your risk universe ?

Expanding business abroad is a source of growth, but it also entails risks for SMEs.

Resilience in times of crisis : Asking yourself the right questions

The Covid-19 pandemic and the accompanying sanitary measures have shaken our daily lives and the way we do business in an unprecedented way.

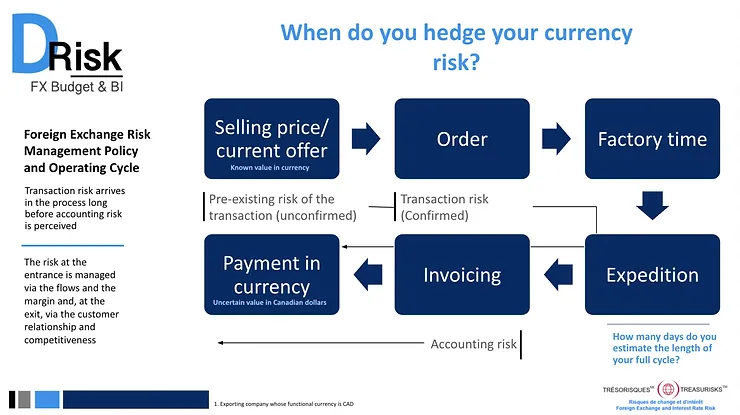

When do you hedge your currency risk?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

What does the Foreign Exchange Risk Management Policy propose ?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

Omicron, inflation, political uncertainty, market volatility, supply chain

The past two decades have taken place against a backdrop of low and stable inflation in many developed markets as opposed to the periods of high inflation of the 1970s and 1980s.

It’s not just the economy that’s growing, uncertainty too!

Evergrande’s situation in China, persistently rising commodity prices, rising inflation in the United States, labor and supply shortages in several economies, the evolution of the pandemic, and central bank interventionism should support the growth of uncertainty in the markets.

Second wave of COVID, political uncertainty, markets volatility, foreign exchange risk

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery.

Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.