Getting ready for a potential second wave of COVID-19

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again. It is therefore imperative to learn from what we harshly experienced during the first wave of COVID-19 and integrate sustainable changes into business and operating models to make them more resilient.

First, it is essential to determine exactly where and how the crisis impacted your existing models and, consequently, where the risks and opportunities are in your value creation ecosystem. This way, the company is able to quickly react to unavoidable changes that will still occur given the unstable environment that will prevail in coming months.

The term “new normal” was very much used lately and, in a risk management context, it simply means that we will be in tail risk scenarios for a while.

Risk management enables an organization to take more significant growth risks and is one of the main differentiation factors of a strong and profitable growth. Business benefits go way beyond avoiding a crisis when risk management is an integral part of the company’s sustainable growth and value creation process.

In fact, when clear processes exist, it is possible to respond efficiently and on a timely basis to a risk that has materialized. An approach based on the analysis of scenarios and their impact can create escalation (and reaction) procedures based on the materiality of potential damages.

When it comes to foreign currency risk, the owner of this risk must have clear parameters because exchange rate changes have an immediate and material impact on a company’s profitability. The escalation threshold must be sufficiently low to take into account the potentially significant consequences of the risk, both in terms of magnitude and duration, if no action is taken.

Using scenarios is in fact the simplest approach to stress testing. This analysis does not attempt to predict future exchange rates. Instead, it offers not only a clear view of the risk exposure through an array of potential exchange rate scenarios, but it also offers a view of the sensitivity of the company’s results to changes in exchange rates considered in these scenarios.

It quantifies the impact of these scenarios on cash flows and helps understanding risk as the variance between likely results (expected in the budget) and the worst cases or defining the risk universe (i.e. difference between the best and worst cases). The way you manage risks should be solid in the face of multiple possible results.

In this “new normal” imposed upon us by COVID-19, the company, whether it is an importer, an exporter or a bit of both, must have the ability to properly quantify its currency exposure so that it can take it into account in comparing the various business models it wishes to develop or modify.

Using scenarios to have a clear view of foreign exchange risks should become the standard for any SMEs with international operations.

The market

While a series of risk-on catalysts is coming to an end¾results announcements on Wall Street, encouraging preliminary results for vaccines, new recovery fund for the European Union, likelihood of a new fiscal stimulus package in the United States and elsewhere in the world¾the environment, which is favourable to risk taking (or retaking), could change due to the recent explosion of COVID-19 in the United States, combined with a hard to follow government response. Future economic indicators should not confirm a V-shaped recovery. Better be prepared for that.

Economic forecasts should therefore be conservative for the remainder of 2020 and 2021. A scenario with greater volatility that is far less unidirectional is developing and should be reflected in companies’ stress tests.

The forecasts prepared by major banks (Canadian or international) differ sharply: some see the Canadian dollar go back to around $1.30 (against the U.S. dollar) while others see it reach $1.45.

On cash flows of USD1 million, this is a $150,000 difference! It’s hard to say anything with conviction about the direction and the level of exchange rates for 2020-2021 when no consensus seems to emerge among these specialized institutions.

What are the implications for SMEs?

The difference between a V-shaped and a U-shaped recovery will be felt on the level of quantities of goods (services) sold / purchased abroad.

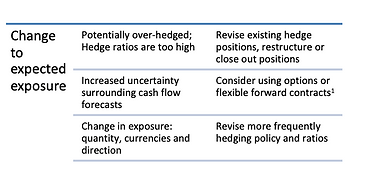

As a result, the foreign exchange risk exposure will therefore differfrom expectations. The impact on your hedging program is direct. The company is potentially over-hedged, resulting in unnecessary costs.

Depending on currency fluctuations since the implementation of your hedge positions, closing out such positions may become a source of liquidity or a cost that is too demanding on your cash. In the latter case, do not hesitate to restructure your hedge position to preserve your cash.

To protect its liquidity, the company must revise any rolling hedge program that could continue at the expense of its liquidity / credit sources.

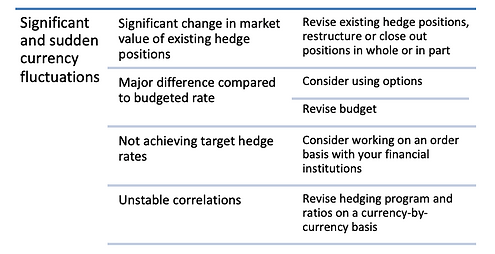

A scenario with greater volatility that is far less unidirectional will bring strong and sudden currency fluctuations, and it is very likely that correlations between currencies will become even more unstable.

Consequently, a company exposed to many currencies can no longer count on the diversification effect since the behaviour of one currency against another varies too much.

In this context of significant and sharp currency fluctuations, develop a plan of execution of your hedging transactions that considers a drastically less liquid market.

Is it possible to roll-over your positions to another time than month-end to avoid the usual traffic and the bottleneck that might result when conditions are less liquid? Set out your hedging positions in tranches to minimize the impact of greater volatility and lesser liquidity.

Select simple hedging products whose market value can readily be estimated should you need to close out or restructure the position. Establish valuation parameters for your positions.

When sharp market fluctuations significantly increase the market value of your hedging position, it may be desirable to close it in part to free up some liquidities. You should however predefine the parameters to authorize such a transaction.

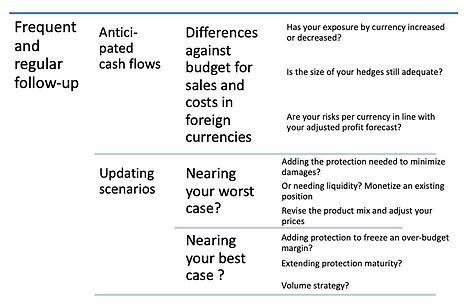

You must have the ability to follow how your exposures are evolving and what sort of differences they may create compared to your target margins.

Revise regularly (and frequently) your anticipated cash flows, review your scenarios based on these new cash flows, reassess your exposure and the relevance and size of your existing hedging positions. The exchange rate scenarios you use in simulations should be sufficiently wide to accommodate the expected volatility.

Protect your sales margins, control your foreign exchange rate and, as much as possible, preserve your flexibility. Be prepared to act instead of being reactive! Without a risk management policy, costs may increase, market share may erode and profit margins may significantly decrease.

Maintaining an explicit relationship between exposures and target margins only reflects the good old risk/return paradigm. In brief, how many days of profit are you willing to put at risk for a given exchange rate fluctuation?

The “new normal” is going to be with us for a good while

The unprecedented central bank and government actions helped supporting companies and financial markets, and this will not be without consequences in time. Will there be inflation or deflation? There are many serious unknowns: the longevity of the virus, the speed at which world economies will recover, the arrival of a second wave, the discovery of a vaccine, its distribution and its cost, etc.

Society will continue to change with this “new normal”. How will consumer behaviour change? Will the consumers’ vision of the political arena and their participation in the election will change? What will be the impact on Brexit? On the European Union? On the U.S. election? What will happen with emerging countries? How will we be able to support those increasing levels of debt? How will the supply change be reorganized? etc.

The “new normal” is already a source of change and transformation. Volatility will tend to stay at higher levels for longer periods. It is best to revise regularly its foreign exchange risk management policy (or implement one) to face this new, developing environment. Be ready!

Note 1:

Flexible futures contract: allows you to fix the rate of purchase or sale of a currency pair today, between two fixed dates and for a specific amount. In addition, and depending on his needs, the holder can exchange the total or partial amount, at any time during the term of the contract, at the pre-agreed rate.

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.