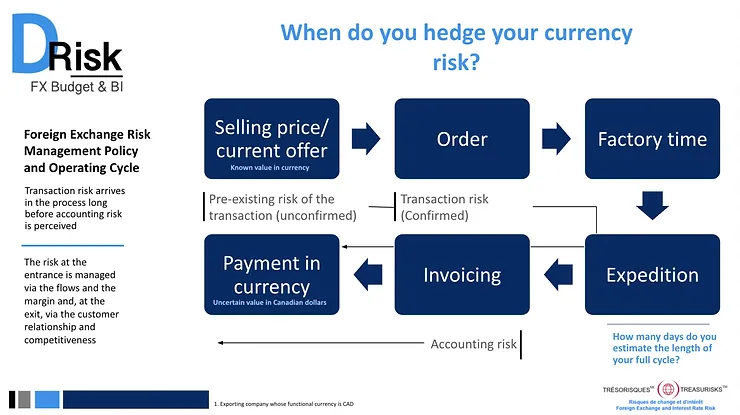

When do you hedge your currency risk?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

What does the Foreign Exchange Risk Management Policy propose ?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

Omicron, inflation, political uncertainty, market volatility, supply chain

The past two decades have taken place against a backdrop of low and stable inflation in many developed markets as opposed to the periods of high inflation of the 1970s and 1980s.

It’s not just the economy that’s growing, uncertainty too!

Evergrande’s situation in China, persistently rising commodity prices, rising inflation in the United States, labor and supply shortages in several economies, the evolution of the pandemic, and central bank interventionism should support the growth of uncertainty in the markets.

Second wave of COVID, political uncertainty, markets volatility, foreign exchange risk

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery.

Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.

COVID-19 Plan for recovery using your risk management policy as an anchor

This article follows the previous one which presented the macro-economic situation related to the COVID-19 pandemic.

Coronavirus and currency risk: What to do?

Coronavirus will change the way we do things for years to come.

Risk Management Policy

Risk can be seen has the probability of an event happening that will have an impact (+ or -) on your business objectives.