Currency Risk Management: Managing Impact and Rapid Volatility

Currency Risk Management Policy Economic Context and Currency Risk Management The dynamic forex market and global economic uncertainties demand heightened vigilance. Factors such as the end of President Biden’s term, central banks’ monetary policies addressing inflation, and geopolitical tensions surrounding the Ukraine war and the Middle East create unpredictable conditions for international trade. As a […]

Digital Transformation, Currency Risk Management and SME

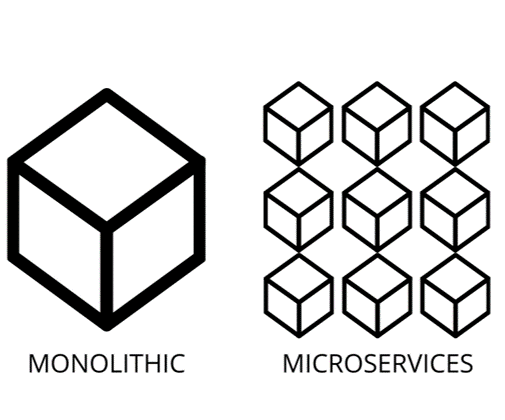

Treasury functions are and will be changed by digital transformation. These new technologies are transforming the way we need to think about treasury and, more specifically, currency risk management.

Currencies and inflation have kept the market on its guard

On inflation, central banks have been stating all along that inflation would fade out fast, and it seems they have been proven right. Inflation is generally slowing down.

COVID-19 Plan for recovery using your risk management policy as an anchor

This article follows the previous one which presented the macro-economic situation related to the COVID-19 pandemic.

COVID-19 Macro-economic / global outlook

The coronavirus will change the way we do things for years.

Coronavirus and currency risk: What to do?

Coronavirus will change the way we do things for years to come.

Go back to basics…

Implementing good technology on top of bad habits (process) will only multiplies garbage outputs and risks.

From forward contracts to options: Presenting instruments mitigating foreign exchange risk

In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.

Foreign Exchange Risk Management Policy: Summary Elements

It is the nature of your operating cycle, of your operations that determines the sensitivity of your profitability to currency fluctuations.