In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.

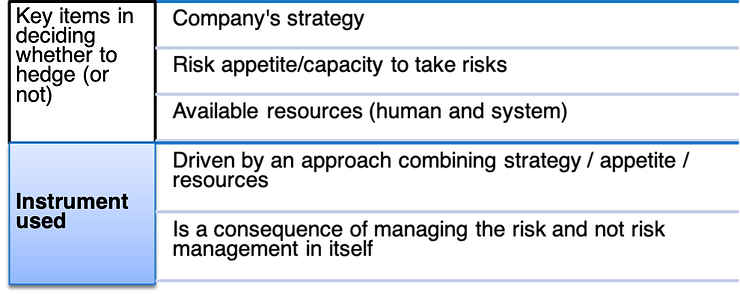

Some financial instruments can be used to mitigate foreign exchange risk. However, before using them, the company has to determine the risk appetite of its main owners and members of management and develop a disciplined working framework (see December 2019 article). In fact, without an appropriate risk management policy (i.e. aligned with the company’s strategy), the company may remain exposed to negative results.

Factors to be considered

The trade-off

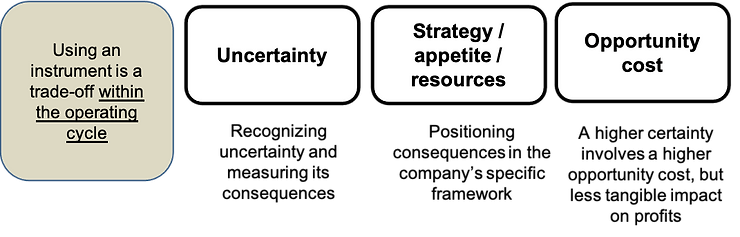

Deciding whether to hedge (or not) is a choice based on weighing uncertainty and opportunity cost. For instance, with a financial instrument, the company knows its cost in advance (specific exchange rate) and therefore eliminates the uncertainty, but it cannot benefit from upside exchange rate fluctuations: the choice involves comparing certainty and opportunity cost.

Forward contract A forward contract is an instrument that allows its holder to know with certainty a future exchange rate. These over-the-counter (“OTC”) contracts are customized, are not regulated and trade on the interbank market.

How it works

The company undertakes (has an obligation) today to buy (sell) at a specified future date a specified quantity of currency A for a specified quantity of currency B. The forward contract protects the company against downside rate fluctuations by locking a specific exchange rate until the agreed-upon date.

The company is therefore protected and knows with certainty its exchange rate. However, it does not benefit from any upside exchange rate movements as it must meet its contractual obligations whether or not the exchange rate fluctuation is favourable to it.

Example: Protection of a U.S. dollar sale with a forward contract

Today, June 26, a Canadian company sells goods for USD100,000 and will be paid in 2 months. On June 26, the forward exchange rate (as at August 26) is 1.32. The company enters into a forward contract at that rate with its financial institution.

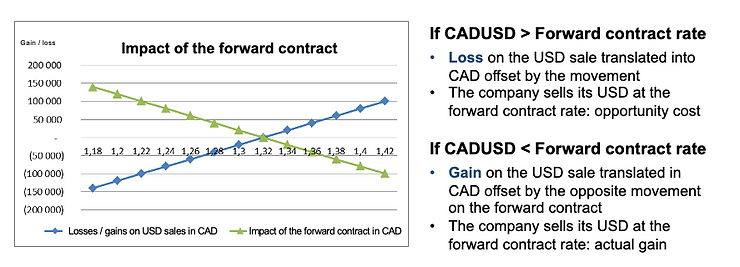

Graphic illustration of the use of a forward contract

Assumption: Forward exchange rate is 1.32

The value of the USD sale in CAD is known when the forward contract is entered into (USD100,000 × 1.32 = CAD132,000) even if the payment in USD will be received a couple of months later. There is no longer any uncertainty as to the value of the USD sale converted into CAD in “exchange” for the opportunity cost if, at expiration date, the rate is above 1.32. The exchange rate can no longer impact the profitability of this sale.

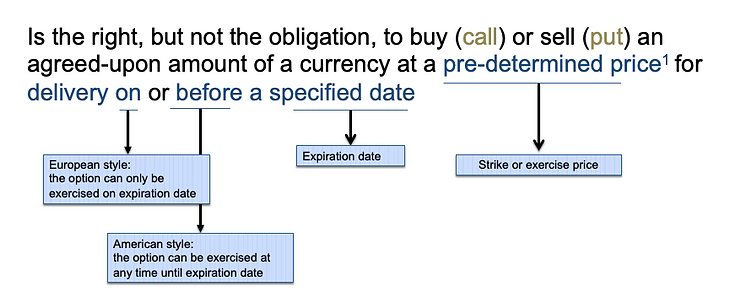

Foreign currency option (Note 1)

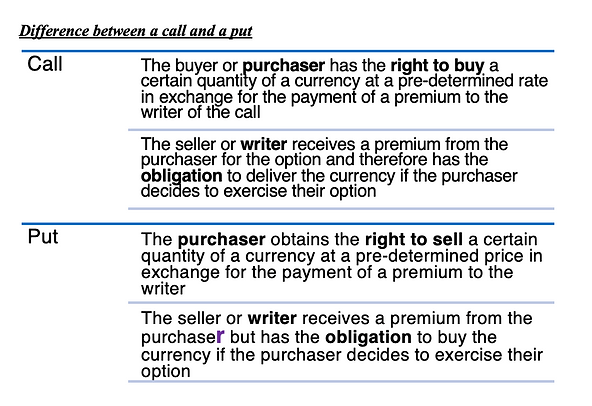

There are many types and variants of options on the market but, in general, they all share these characteristics. Therefore, an option:

Example: Protection of a U.S. dollar sale with a foreign currency option

(Same assumptions as in the forward contract example)

The company purchases today from its financial institution a put on the U.S. dollar at a strike price of 1.32 expiring on August 26. The company pays a CAD2,000 premium.

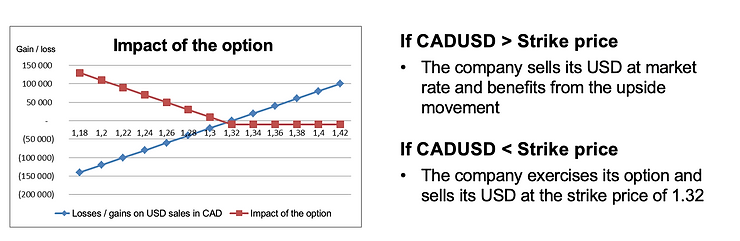

Graphic illustration of the use of a foreign currency option

Assumption: Strike price is 1.32

The option gives the company the right, but not the obligation, to sell the U.S. dollars it will receive in 2 months at a pre-determined price. If the company exercises its right, the counterparty is required to purchase the USD from the company at the strike price.

The company knows today the floor rate at which it will be able to sell its currencies at the expiration date. The minimum value of its USD sale in CAD is known (CAD130,000) as soon as it purchased the option, i.e. the strike price less the premium (in this case, CAD2,000). The company pays the premium (note 2) to ensure it gets a floor rate and benefits from an upside movement.

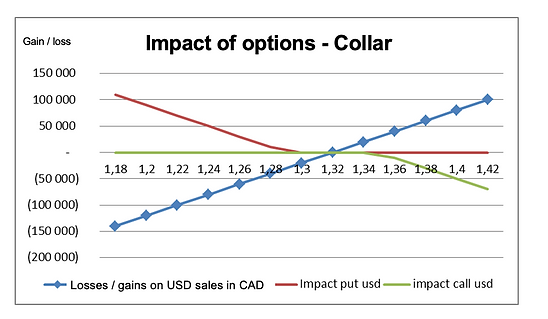

The collar or tunnel

The combination of a put and a call on the U.S. dollar with different strike prices creates a collar or tunnel. When the value (premium paid) of the put equals the value (premium received) of the call, we obtain what is called a zero-cost collar.

The choice of strike price creates the zero-cost collar. For instance, the purchase of a put with a strike price of 1.29 can be paid with the sale of a call with a strike price of 1.35.

When the CAD appreciates below 1.29, the loss on the USD sale translated into CAD is offset by the opposite movement on the put. When the CAD depreciates beyond 1.35, the gain on the USD sale translated in CAD is offset by the opposite movement on the call.

The company knows today the floor rate of 1.29 and the cap rate of 1.35 at which it will be able to sell its foreign currency at the expiration date. The minimum value of its USD sale in CAD at expiration will be CAD129,000 and the maximum value will be CAD135,000 as soon as the collar is entered into.

In fact, a cap above the forward contract rate is established in “exchange” for a floor lower than the forward contract rate. With the collar, the company can limit its exposure (1.32 to 1.29) to benefit from upside movements with a certain limit (1.32 to 1.35)

To summarize, the collar is a commitment to transact on a determined amount, during a specified period and within a price range that is known in advance.

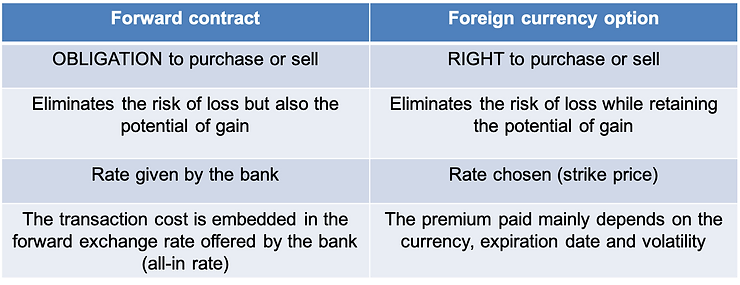

The following table presents the distinguishing characteristics of two broad families of foreign exchange risk hedging instruments.

These instruments bring their full value when they are used within a disciplined framework that is aligned with the company’s strategy. Getting the right combination of expertise, information, tools and clear processes enables a company to obtain the full benefits of foreign exchange risk management.

The involvement of Treasurisks provides companies with the expertise and support needed to develop solid and profitable reference points in foreign exchange risk management.

Note 1: There are several types and variants of currency options on the market. Note 2: The option premium could be quite high depending on some factors such as duration, strike price and volatility.

______________________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.