The extent of foreign exchange risk

During the last few weeks, many items brought instability to the markets.

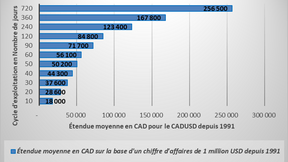

Foreign currency Risk

Currency risk is the risk that a company’s financial situation might be affected by variations in exchange rates. This risk is especially present for companies that trade in more than one currency.