Different sources of currency risk

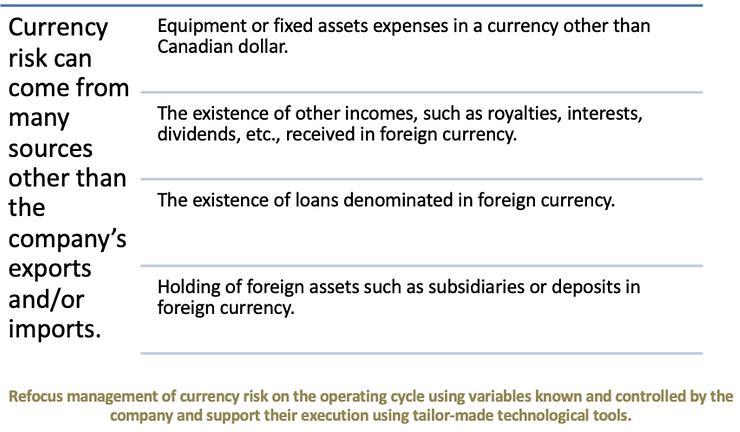

Currency risk is the risk that a company’s financial situation might be affected by variations in exchange rates. This risk is especially present for companies that trade in more than one currency.

For example, those who sell in other countries where customers pay in their own currency, or those who buy products and/or services in a currency different than their functional currency, in this case, the Canadian dollar.

Currency risk must be managed so that the company remains focused on its primary mission, its business operations, without exposing it unduly to financial risks.

Evaluate currency risk

There are many ways to evaluate currency risk, some more complex than others. Sophisticated measures, like « value at risk (VaR) », can require a lot of data, be mathematically complex without, however, having a great added value for the SME. We will look at some simpler measures that can easily be applied and implemented by most SMEs.

Register of foreign currency exposures

This method is very simple. It aims to maintain a register of exposures (commercial transactions) and their associated currency hedging transactions (forward contract, option, etc.). Therefore, the details of each hedging transaction are calculated against the exposure to be hedged. After converting the result of the hedging transaction in Canadian dollar, profitability can easily be determined by applying the results to the obtained value of business transaction’s cash flow.

Anticipated cash flow schedule

When a company pays and receives in various currencies, it is necessary to measure the net surplus (or the net deficit) generated by commercial transactions in each currencies. This is done by projecting the cash flow in foreign currencies. This business cash flow forecast indicates not only whether the business has a surplus or is short of a currency, but also the presumed dates when these cash flows are expected.

Sensitivity analysis

In addition to cash flow schedule, a company may undertake a sensitivity analysis to determine the potential impact of an unfavourable movement in exchange rate on commercial transaction profitability. This can be done by choosing arbitrary exchange rate movements or based on previous variations. The company will thus know how much its commercial profitability is impacted for a given change in the exchange rate.

Knowing that, the company can establish a threshold from which it is imperative to be covered. When materials such as petroleum, resin, wood, etc. are involved, companies frequently develop a matrix showing the combined result of variations in currency and commodity prices in order to evaluate risk level.

Value at risk (VaR)

In closing, a few words on VaR. It is mainly financial institutions that use this kind of approach, combining probability and sensitivity analysis. The analysis seeks to determine, in addition to the potential impact of a given change in Canadian dollar (i.e. a 1 USD cent movement), the frequency of the movement.

Very briefly, this involves performing a sensitivity analysis of the cash flow schedule based on historical exchange rates in order to provide a statistical interpretation of risk. Then, considering the current position of the company, and based on the exchange rates of the last two years, for example, we try to determine, for a given probability, that the company will not lose more than a certain amount due to a change in exchange rates. In short, the company used historical exchange rates to model the potential impact of exchange rate variations on current exposures.

After identifying and measuring potential exposure, the next challenge is to manage it. There are many tools for that, which will be discussed in the next article. However, it must be clear that the use of those tools is not exchange rate risk management as such; it is only the consequence of it.

In fact, at TREASURISKS, we believe that currency risk management consists in processes that need to be done in upstream of the use of these tools. Processes that make the company ready to control the potentially harmful effects of an unfavourable movement in exchange rates or the strategic approach that makes it also ready to capitalize commercially on favourable movements of currencies without taking speculative positions. The primary objective is always the commercial success of the company.

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.