Build your tool to compare the performance of different markets during budget planning

In the second article on volatility [1], we discussed how to compare different international transactions on an equivalent basis to account for the impact differential on profitability generated by currencies.

Two markets, one measure? How to assess the hidden currency risk in the budget?

In a previous article, we discussed the use of volatility as a measure of uncertainty, the factors that influence it, and its impacts on SMEs.

Resilience in times of crisis : Asking yourself the right questions

The Covid-19 pandemic and the accompanying sanitary measures have shaken our daily lives and the way we do business in an unprecedented way.

Omicron, inflation, political uncertainty, market volatility, supply chain

The past two decades have taken place against a backdrop of low and stable inflation in many developed markets as opposed to the periods of high inflation of the 1970s and 1980s.

Second wave of COVID, political uncertainty, markets volatility, foreign exchange risk

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery.

Choose to cover yourself (or not) on a factual and non-emotional basis

Changes in the value of the Canadian dollar can significantly impact the profitability of a company and the valuation of its operations abroad (import and/or export).

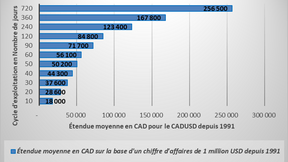

The extent of foreign exchange risk

During the last few weeks, many items brought instability to the markets.