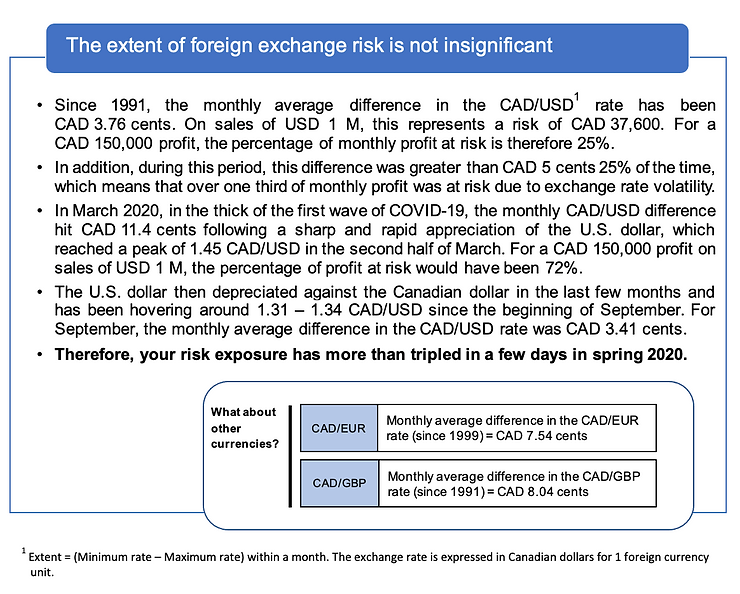

During the last few weeks, many items brought instability to the markets. The U.S. election, Brexit, the second wave of COVID-19 and the growing debt of countries resulting from the extraordinary measures taken by governments around the world to curb the health crisis are only a few examples of these items. The foreign currency market, likely the most unstable asset class in the world, has not escaped this trend.

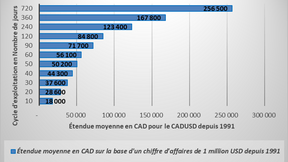

The extent of risk is already quite significant in “normal” conditions to warrant special attention. The above example shows that, in a crisis situation, the size of exchange rate variations and the speed at which they occur can have a strong impact on your financial results. It clearly shows that there is a need for a foreign exchange risk management policy.

Foreign exchange risk is among those risks that are said to be rapidly spreading and have a severe impact. Businesses should therefore be even more wary of these high-velocity risks as they quickly hit organizations. A foreign exchange risk management policy is a necessity as exchange rate fluctuations, both in terms of direction and magnitude, are sudden and unpredictable and can be very significant.

To take further action:

Foreign Currency Risk

Risk Management Policy

COVID-19 Plan for recovery using your risk management policy as an anchor

International markets: a world of opportunities

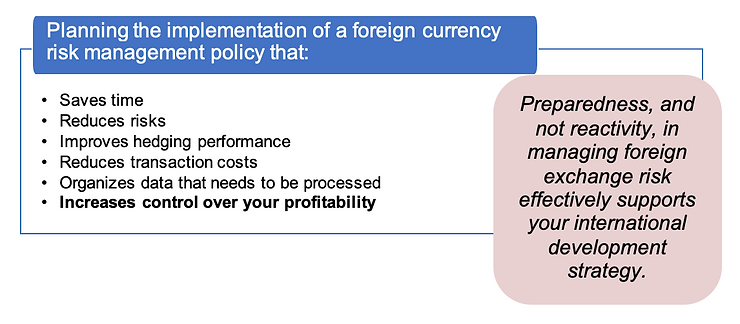

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.