Basic notions to help the importer or exporter working internationally, to better transact on the foreign exchange market. It will cover market conventions, different types of transactions, certain mechanisms, pricing of currencies in order to facilitate your intervention in the foreign exchange market.

D-Risk FX budget & BI Plateforme infonuagique (SAAS)

Basics of the foreign exchange market

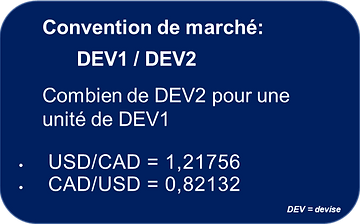

The currency market (FX or forex) refers to the sale and purchase of currencies against other currencies at current or determined prices. Currencies are always traded in pairs, i.e. in relative value.

The role of the FX market is to determine the price of one currency when it’s paid with another. It’s by far the largest market in the world. Foreign exchange transactions averaged $6.6 trillion per day in April 2019 (1).

The interbank market is exclusively composed by financial institutions. It’s a decentralized market and each financial institution records and manages its own transactions. The interbank market brings together interbank transactions and transactions of institutional, corporate and retail investors through their financial institutions.

The activities of all these players generate the prices of the current currencies. The interbank market impacts all valuations due to its volume and expertise.

The currency tarification

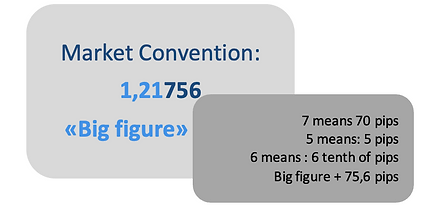

Spot prices of currencies are usually quoted using between 4 and 6 significant digits. EUR/USD, the most traded currency pair in the world, is quoted at 5 significant digits for example, 1.20269.

Currencies have a bid price (“Bid” or asking price) and an ask price (“Ask” or offered price). For example:

Bid Ask

USD/CAD 1,21756 1,21761

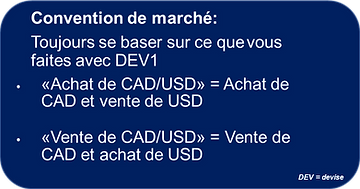

The bid price is when the bank buys CUR1 (USD) and the ask price is when the bank sells CUR1 (USD). The difference between the bid price and the ask price is called the “spread”. Spreads on the interbank market are very tight which is not the case when each bank makes its own market for its customers.

In our example, the bank is willing to buy USD against CAD (CUR2) at 1.21756 and is willing to sell USD against CAD (CUR2) at 1.21761. The spread is therefore 0.00005.

People involved in currency trading call the first part of the rate (up to 2 decimal places) the “Big Figure”. In this case 1.21. Traders normally quote only the last 2 digits of the rate (3 digits for some currency pairs). These numbers are known as “pips”. As a rule, only “pips” are quoted when trading is done over the phone. E-commerce systems display the entire rate with pips, most of the time, having an accentuated visibility.

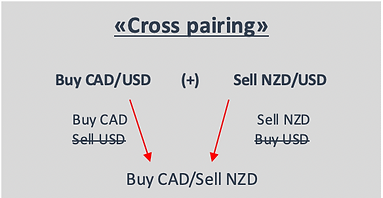

The currency transaction mecanism Some currencies are traded against one another as standard interbank currency pairs and therefore a price is available at all times. All other pairs are called a “cross trade” or “cross pairing”.

The currency transaction mecanism

Some currencies are traded against one another as standard interbank currency pairs and therefore a price is available at all times. All other pairs are called a “cross trade” or “cross pairing”.

Interbank transactions and most customer transactions are always traded in CUR1 amounts, regardless of the currency pair.

Even though CAD/USD is a standard currency pair quoted at 0.82132, a Canadian SME may need to process an amount in USD (CUR2) rather than an amount in CAD (CUR1).

The rate shown will be the same, but instead of multiplying the CAD amount by the CAD/USD rate (CAD amount x 0.82132) to produce a USD amount, the USD amount is divided by the CAD/USD rate (USD amount / 0.82132 ) to produce a CAD amount.

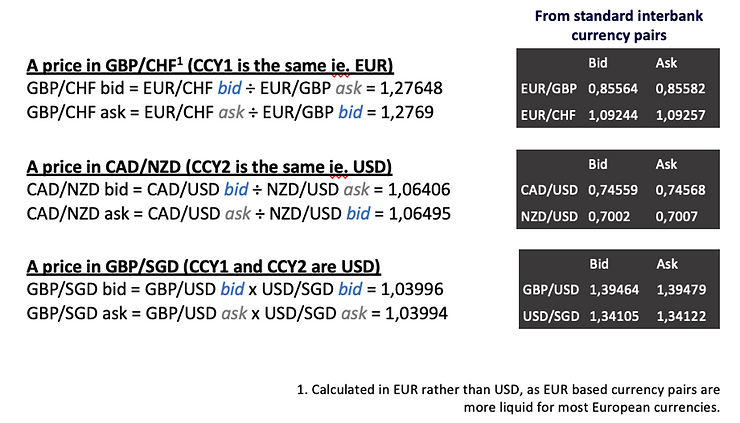

How to calculate the price of a “cross trade”?

Please note that the spread of a “cross trade” is always wider because it includes the spread of the two standard pairs from which it is derived.

Type of transaction on the currency market.

Most banks/brokers have a separate group known as

“Sales and Currency Trading Department”.

This department takes orders from the client (company/investors, etc.), then requests, for example, a quote from the trader (who has access to the interbank market) at the spot rate, and then gives the quote to the client to see if he wants to trade on this price. There is a wide choice of orders that you can use.

Orders executed immediately at the prevailing rates are called market orders. A “stop” order is an order to buy or sell at a specified price. A limit order is an order to buy or sell at a specified price executed at the limit price or better.

In recent years, online foreign exchange transactions have become more common, but many SMEs still deal with their account manager at the bank or, depending on their size, directly with the trading floor of a financial institution.

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.