Strengthen Your Currency Risk Management to Protect Against Market Volatility

In today’s unpredictable economic and political landscape, it is essential for businesses to implement a robust currency risk management strategy. This not only helps in mitigating risks but also allows companies to regularly assess the effectiveness of their measures to safeguard profit margins. As such, currency risk management has become critical for business sustainability.

Exchange Rate Volatility and Currency Risk Management

Exchange rate movements are inherently unpredictable. Financial institutions and specialized organizations may periodically release exchange rate forecasts, but when comparing forecasted exchange rates with actual market rates, significant differences often emerge. For companies exposed to foreign exchange (FX) risk, basing business decisions solely on forecasts is risky. Instead, focusing on a currency risk management strategy is essential to anticipate the potential impact of market volatility on profit margins, which can be significantly affected by unexpected currency fluctuations.

A Strong Currency Risk Management Strategy for SMEs

A sudden appreciation of the Canadian dollar can offer an advantage for importing companies by lowering costs. However, businesses with significant foreign currency revenue may face challenges, as the value of these revenues in Canadian dollars diminishes. Therefore, setting up a solid currency risk management and hedging strategy is crucial for any company engaged in international trade. Although forecasts may support strategic decisions, they cannot replace an effective currency risk management approach.

Focus on Margins, Not Market Predictions for Effective Currency Risk Management

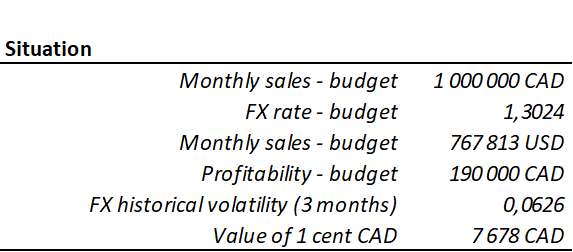

As we begin the new year, it’s worth questioning if your current currency risk management strategy is sufficient to handle unexpected market downturns. In the FX market, sudden changes are common, and even minor delays in monitoring can undermine your ability to adjust effectively. For instance, your company may project monthly sales of USD 767,813 in the United States, with a budget exchange rate of 1.3024 USDCAD and a targeted monthly profitability of CAD 190,000.

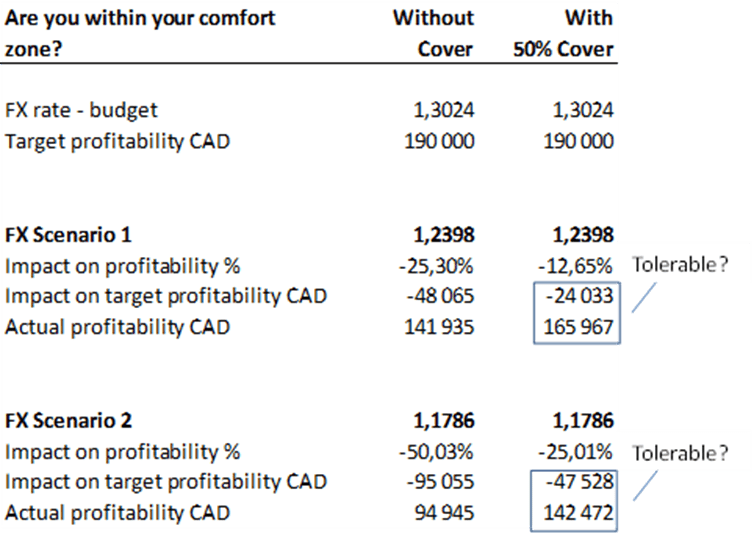

Based on this budget [1], the tolerance threshold rate of 1.2398 USDCAD indicates a 25% profitability loss without hedging. Implementing a currency risk management strategy using forward contracts to hedge 50% of this exposure could mitigate losses in adverse scenarios. The first scenario, with a tolerance threshold at 1.2398 USDCAD, would allow your company to achieve 87% of its expected profitability. In a more extreme second scenario, with a rate of 1.1786 USDCAD, profitability would drop to 75% [2].

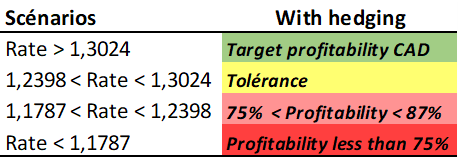

Scenario 1 corresponds to the base scenario i.e., the adverse movement against which you hedge for a given amount of tolerance [2]. Scenario 2 corresponds to your divergence scenario i.e., your worst case. The role of the coverage ratio [3] is to minimize margin impact if the 1.2398 USDCAD threshold is reached in the market. At the start of your hedging strategy, this scenario assumes a tolerance for an adverse movement of approximately six Canadian cents from the budget rate (1.3024 to 1.2398). This would result in 87% of expected profitability. With a movement of approximately twelve cents (1.3024 to 1.1786), profitability drops to 75%. Over time, as exchange rates fluctuate, your comfort with these scenarios may change. For example, if the spot rate in a few months reaches 1.25 USDCAD, does your strategy still align with your risk tolerance [4]?

Regular and timely tracking between the spot rate and tolerance levels can significantly enhance your currency risk management effectiveness, saving both time and money while protecting margins.

Simplify Your Currency Risk Management with D-Risk FX

D-Risk FX streamlines currency risk management by integrating it into your budgeting process. With real-time tracking and automated risk assessments, D-Risk FX enables businesses to take proactive actions to safeguard margins and achieve financial objectives. From budgeting to execution and ongoing strategy monitoring, D-Risk FX offers a complete currency risk management solution tailored to meet your business needs.

[1] Currency Risk: How To Take Volatility Into Account In Your Management?

[2] Two Markets, One Measure? How To Assess The Hidden Currency Risk In The Budget?

[3] To know more on tolerance see : Is A Coverage Ratio Of 70% Too Much Or Insufficient?

For more on currency risk management strategies, visit related articles like Currency Risk Management: 5 Tips to Improve Your Approach and Bank of Canada – Managing Currency Risk.

Exploring International Markets : A World of Opportunities

Expanding abroad can drive growth, but it also introduces risks for SMEs. The cumulative effects of exchange rate fluctuations can be challenging to monitor. D-Risk FX Budget & BI provides SMEs with performance analytics, risk assessments, and stress-testing scenarios across different markets, currencies, and business lines, empowering companies to approach foreign markets with a robust currency risk management strategy.