Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.

COVID-19 Plan for recovery using your risk management policy as an anchor

This article follows the previous one which presented the macro-economic situation related to the COVID-19 pandemic.

Coronavirus and currency risk: What to do?

Coronavirus will change the way we do things for years to come.

Go back to basics…

Implementing good technology on top of bad habits (process) will only multiplies garbage outputs and risks.

From forward contracts to options: Presenting instruments mitigating foreign exchange risk

In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.

Foreign Exchange Risk Management Policy: Summary Elements

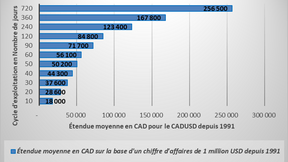

It is the nature of your operating cycle, of your operations that determines the sensitivity of your profitability to currency fluctuations.

Foreign Exchange Risk: Defining a cash flow

Running a company is no small task. Identify potential customers and win them over; finance and develop the company; in short, manage an operating cycle efficiently, from beginning to end.

Choose to cover yourself (or not) on a factual and non-emotional basis

Changes in the value of the Canadian dollar can significantly impact the profitability of a company and the valuation of its operations abroad (import and/or export).

The extent of foreign exchange risk

During the last few weeks, many items brought instability to the markets.