Resilience in times of crisis : Asking yourself the right questions

The Covid-19 pandemic and the accompanying sanitary measures have shaken our daily lives and the way we do business in an unprecedented way.

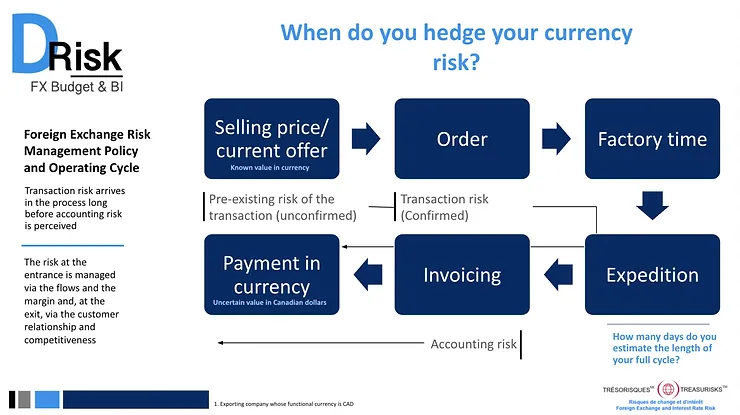

When do you hedge your currency risk?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

What does the Foreign Exchange Risk Management Policy propose ?

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

Second wave of COVID, political uncertainty, markets volatility, foreign exchange risk

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery.

Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.

COVID-19 Macro-economic / global outlook

The coronavirus will change the way we do things for years.

Coronavirus and currency risk: What to do?

Coronavirus will change the way we do things for years to come.

Go back to basics…

Implementing good technology on top of bad habits (process) will only multiplies garbage outputs and risks.

From forward contracts to options: Presenting instruments mitigating foreign exchange risk

In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.