Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.

COVID-19 Plan for recovery using your risk management policy as an anchor

This article follows the previous one which presented the macro-economic situation related to the COVID-19 pandemic.

From forward contracts to options: Presenting instruments mitigating foreign exchange risk

In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.

Foreign Exchange Risk: Defining a cash flow

Running a company is no small task. Identify potential customers and win them over; finance and develop the company; in short, manage an operating cycle efficiently, from beginning to end.

Choose to cover yourself (or not) on a factual and non-emotional basis

Changes in the value of the Canadian dollar can significantly impact the profitability of a company and the valuation of its operations abroad (import and/or export).

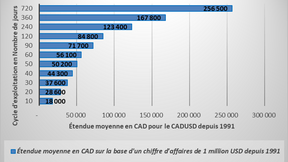

The extent of foreign exchange risk

During the last few weeks, many items brought instability to the markets.