The current political and economic uncertainty underscores the importance of companies implementing FX risk management strategies and being able to assess their effectiveness on a regular basis to protect their bottom line.

Foreign exchange market forecasts.

Currency movements are impossible to predict. It is true that financial institutions and specialized organizations periodically publish their forecasts, but when these exchange rate forecasts are compared to reality, large disparities can be observed.

For companies exposed to currency risk, it is not advisable to base their business decisions on these forecasts. Fluctuations in currency markets and, in particular, unexpected volatility, can significantly erode profit margins.

A sudden appreciation in the value of the Canadian dollar could be an excellent opportunity for companies that import, as it will result in lower foreign currency costs. However, for those who have foreign currency sales, it will pose significant problems as the value of these sales in Canadian dollars will be reduced.

Therefore, it is essential to establish and implement an appropriate currency hedging strategy for your business and to monitor it regularly when conducting business in international markets[1]. Forecasting can be a complementary tool to an effective currency risk management strategy, but not a substitute for it.

Anticipate your margins, not the markets.

As the year begins, are you confident that your current currency risk management strategy will adequately protect you if the FX rates are worse than expected? In the currency markets, it is not uncommon for things to change drastically very quickly.

Comparing indicators such as profitability due to currency movements, based on 4 simulated situations, can ensure that the strategy in place will continue to be effective.

Let’s look at an example.

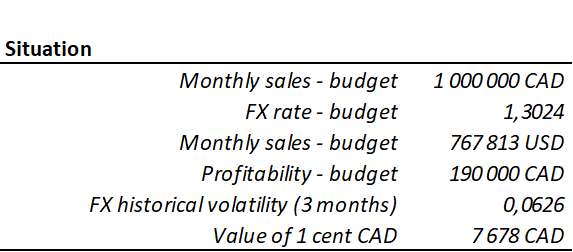

Your company expects to make monthly sales of USD 767,813 in the United States. Your operating cycle is 3 months, and your budget rate is 1.3024 USDCAD. Your target profitability is CAD 190,000.

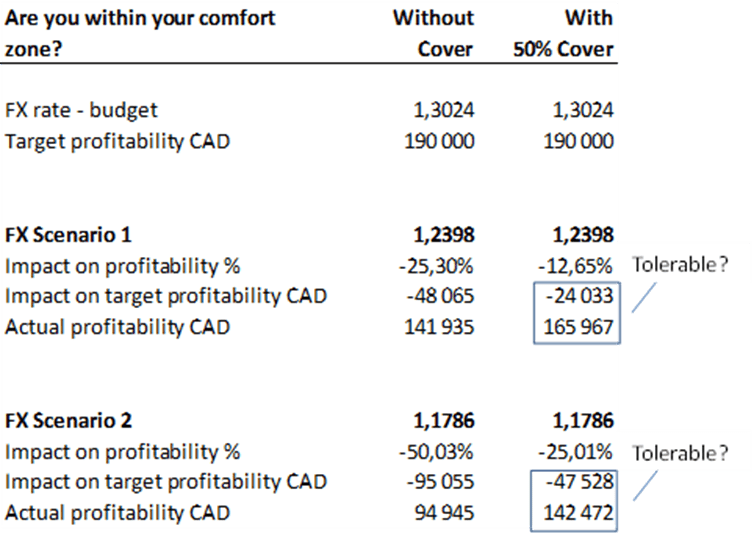

Based on your budget[2], you have established your target profitability and that without hedging, a threshold rate of 1.2398 USDCAD, based on historical volatility, would cause you to lose 25% of that profitability. Are you comfortable with this first scenario? In a second, more extreme scenario, a rate of 1.1786 USDCAD would cause you to lose 50% of your profitability. You designed your hedging strategy to reduce this risk by half, using FX contracts to achieve a 50% hedge ratio. These scenarios are summarised in the table below.

Scenario 1 corresponds to the base scenario i.e., the adverse movement against which you hedge for a given amount of tolerance[3]. Scenario 2 corresponds to your divergence scenario i.e., your worst case.

The role of the hedge ratio[4] is to reduce the impact on your margins in the event the market reaches the 1.2398 Canadian dollar (CAD) per US dollar (USD) threshold.

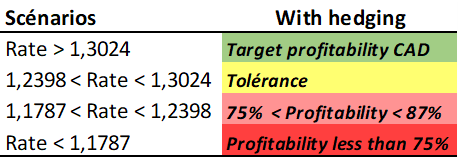

At the start of your hedging strategy, you are comfortable that with an adverse movement of just over 6 cents Canadian to the budget rate (1.3024 to 1.2398), you will achieve 87% of your expected profitability; if the adverse movement is just over 12 cents Canadian (1.3024 to 1.1786), it will be 75%.

On the other hand, depending on the evolution of the rates, your comfort level with these 2 scenarios will probably change. For example, if in a few months the spot rate becomes 1.25 USDCAD, are you still as comfortable?

Setting these basic parameters at the outset allows you to monitor the effectiveness of your strategy quickly and easily in response to market movements and better protect your margins.

Are you still comfortable with the gap between the spot rate and the threshold rates implied by your hedge ratio? Should you add more hedge contracts (increase your ratio) to further reduce the impact on your margins before your profitability is reduced to 75% of your target?

Regular monitoring of spot and threshold rates allows you to save time and money by maintaining the effectiveness of your strategy. On the other hand, long delays between follow-ups could undermine the effectiveness of the adjustments you need to make to restore the balance between risk and your risk tolerance.

D-Risk FX facilitates the development of your foreign exchange risk management strategy by treating it as part of your budgeting process and making it simple and accessible to monitor in real time. By linking your margin to the exchange rate from the moment you set up your budget, D-Risk FX enables you to act in time to protect the company’s profits and limit its losses to achieve your objectives.

[1] See : Currency Risk: How To Take Volatility Into Account In Your Management?

[2] See : Two Markets, One Measure? How To Assess The Hidden Currency Risk In The Budget?

[3] To know more on tolerance see : Is A Coverage Ratio Of 70% Too Much Or Insufficient?

[4] See: How To Choose Your Hedging Ratio?

______________________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI offers SME performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.