Is Your Currency Risk Management Strategy Sufficient in Times of Uncertainty?

Strengthen Your Currency Risk Management to Protect Against Market Volatility In today’s unpredictable economic and political landscape, it is essential for businesses to implement a robust currency risk management strategy. This not only helps in mitigating risks but also allows companies to regularly assess the effectiveness of their measures to safeguard profit margins. As such, […]

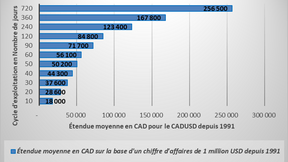

Build your tool to compare the performance of different markets during budget planning

In the second article on volatility [1], we discussed how to compare different international transactions on an equivalent basis to account for the impact differential on profitability generated by currencies.

Second wave of COVID, political uncertainty, markets volatility, foreign exchange risk

With the second wave of COVID-19 raging, confinement measures resuming and uncertainty around the global economic recovery.

Foreign exchange risk, U-shaped or V-shaped recovery?

Without any vaccines or drugs against COVID-19, any rebound in economic activity could suddenly stop in its tracks once again.

From forward contracts to options: Presenting instruments mitigating foreign exchange risk

In a previous article (Foreign currency risk), we addressed identifying and measuring foreign exchange risk so it can be managed in such a way that the company remains focused on its core mission, its business operations, without being overly exposed to financial risks.

The extent of foreign exchange risk

During the last few weeks, many items brought instability to the markets.