In a previous article, we discussed the use of volatility as a measure of uncertainty, the factors that influence it, and its impacts on SMEs. In this new article, we will discuss currency volatility in the context of budget preparation. Closing a budget when exporting and/or importing in one or more currencies can be a challenge.

The variability in the value of sales or budgeted costs in different currencies is different and, therefore, impacts cash differently, especially available cash, and ultimately, your profit.

It becomes important, within the budgetary process, to be able to make comparable transactions that will be carried out in different foreign markets to make the right choices.

For example, at what price is a supplier in Mexico (pesos) more profitable than a supplier in the United States (US$)? It is necessary to link profitability and risk from the budget process to make them comparable.

To achieve this, let us give ourselves orders of magnitude on the uncertainty, the risk surrounding the transactions that we plan on a budget in different foreign markets.

Interpreting currency volatility

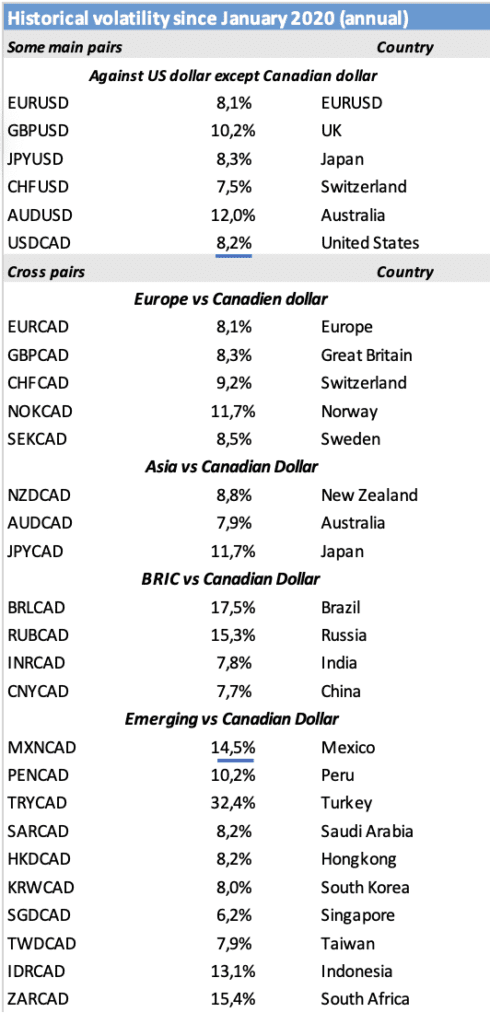

So-called exotic currency pairs are generally the most volatile in the foreign exchange market because their liquidity [1] is often lower than that of major or main pairs. For example, Turkey, Brazil, Russia and Mexico have some of the most volatile currencies. [2]

The main pairs are therefore usually the least volatile but note that since 2020, even on these, volatility has increased.

Let’s take a closer look at the Mexican and American markets.

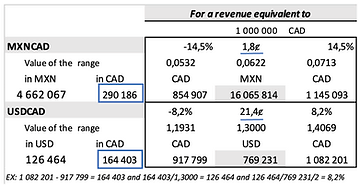

The Canadian dollar (CAD), for example, against the US dollar (USDCAD) with a historical volatility of 8.2% has a range of possible values of more than 21 Canadian cents.

So, for an average rate throughout 1.3000 USDCAD, this range will be from 1.1931 to 1.4069. Statistically speaking, there is a 68% [3] probability that rates will trade within this range.

Repeating the same exercise with the Mexican Pesos (MXN), for the volatility of 14.5% and an average rate of 0.0622, the trading range is 0.0532 to 0.0713 or 1.8 Canadian cents.

We notice here the effect of scale. The MXNCAD is more variable (14.5%) than the USDCAD (8.2%) nevertheless, the trading range for the USDCAD is a lot broader. Let’s take a closer look at this scale effect because percentages if misinterpreted, can sometimes mislead us.

The basis (0.0622 and 1.3000) on which these percentages are estimated must be taken into account. For illustrative purposes, a business transaction size equivalent to 1 million in Canadian dollars [4] is used.

A change of 0.9 (1.8 ÷ 2) [5] Canadian cents in a transaction in Mexico can generate a gain or loss of CAD 145,093 (290,146 ÷ 2) while a change of 10.7 cents (21.4 ÷ 2) Canadian cents on a transaction in the United States generates a gain or loss of CAD 82,201 (164,403 ÷ 2).

If the CAD moves 1 cent against the USD and MXN, the gains or losses will not be the same. For the transaction in Mexico, it will be a variation of 160,659 CAD while for the American transaction it will be 7,692 CAD. A movement of 1 Canadian cent against the MXN is a movement of more than 16% while against the USD, this percentage is barely 1%.

So for the same size of commercial transaction in CAD, the value of a movement of 1 Canadian cent i.e. its impact on cash and the commercial profitability of the SME will not be the same from one currency to another.

This differential must be explicitly taken into account in budget planning because, on the one hand, the coverage needs will not be the same and, on the other hand, it is clear, for example, that being able to win $ 10 at the risk of losing $ 3, should be preferred to be able to earn $ 10 by risking losing $ 8.

And it is exactly this choice that is faced by Canadian SMEs operating in different markets.1 million CAD for sale / or purchase on the Mexican market is not equivalent to 1 million cad for sale or purchase on the US market. It is the famous risk/return couple that, from budget planning, makes it possible to make transactions on the different markets “equivalent”.

You are now able to compare the risks of your different international transactions on an equivalent basis. We will discuss integrating these risks into budget planning to associate them with your strategic choices in a future article.

[1] Read more : Currency risk: How to take volatility into account in your management? [2] Read more : Currency market : Basic information on the functioning of the market

[3] Movements that fall within the 1X, 2X and 3X ranges of the standard deviation are expected to occur 68.3%, 95.5%, and 99.7% of the time, respectively. [4]The impact of a 1 CAD cent change for an MXN 1 million commercial transaction or a $1 million commercial transaction is CAhttps://www.d-riskfx.com/?lang=enD 10,000. To properly compare volatility, we must work based on a transaction of 1 million in reference currency (the functional currency) which, in our example, is the Canadian dollar. The anticipated range is based on annual volatility. [5] Division by 2 to take into account that this is the percentage of volatility on each side of the average (+/-14.5%).

__________________________________________________________

International markets: a world of opportunities

Expanding business abroad is a source of growth, but it also entails risks for SMEs. It is also complex to monitor the successive impacts of exchange rates on the company’s anticipated performance.

D-Risk FX Budget & BI, offers SMEs performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company’s anticipated performance.

Gain autonomy, automate your processes and approach your foreign markets with the security of a clear foreign exchange risk management strategy and monitoring that matches your ambitions.