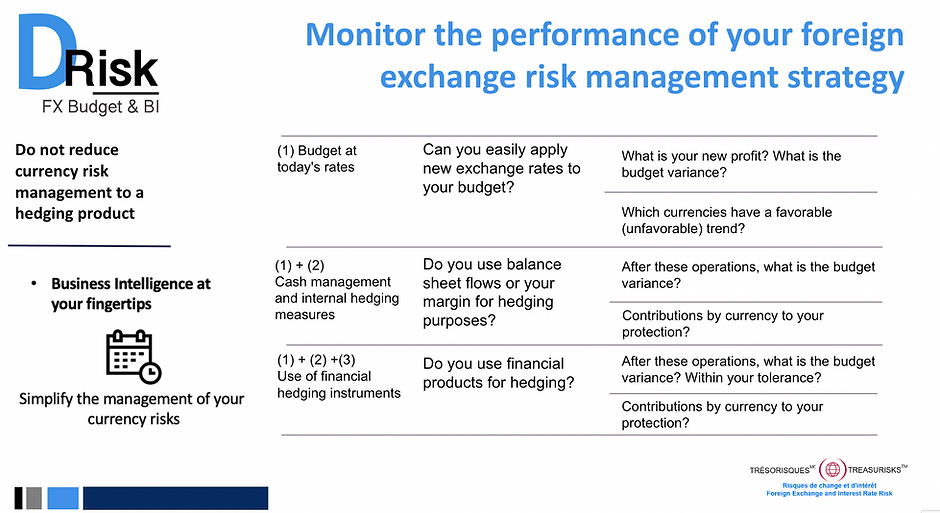

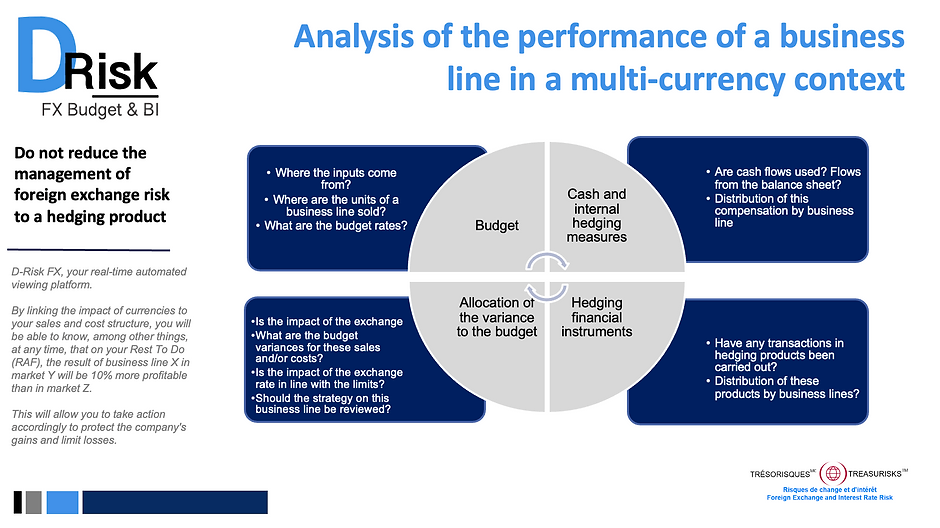

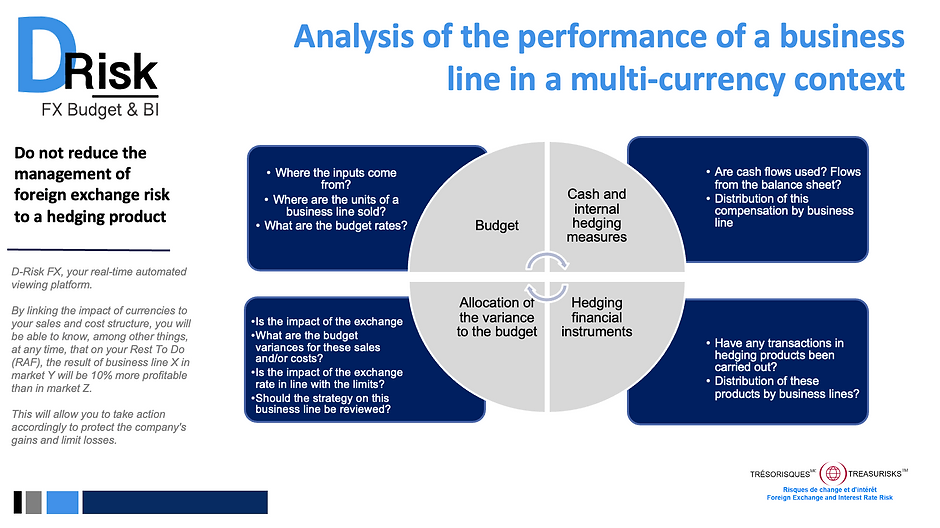

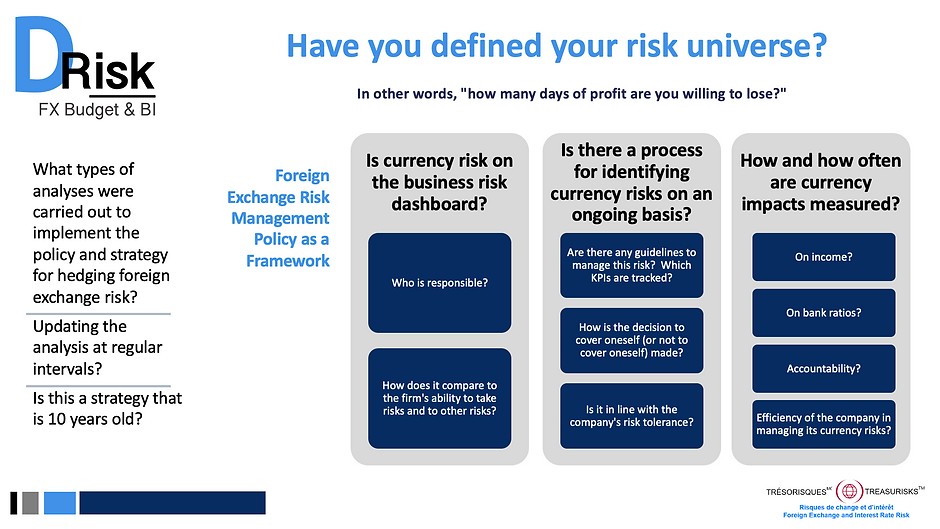

Discover D-Risk FX Budget & BI

Multi-currency and multi-market cloud-based decision support platform. It offers SME performance, risk and test scenario analyses, broken down by market, currency and business line, with a tailor-made hedging strategy and real-time monitoring of the company's anticipated performance.